Strengthening Defences: Navigating Insurance Fraud Prevention with SAS

Register Now

Strengthening Defences: Navigating Insurance Fraud Prevention with SAS

OVERVIEW

In this fireside chat webinar will be delving into emerging trends impacting fraud, from the rise of organised fraud activities to the transformative power of digital tools and changing customer expectations. It will also discuss effective strategies and cutting-edge techniques for combatting fraud across various sectors, including agent fraud, motor insurance fraud, and health insurance fraud.

At the heart of the discussion lies the role of SAS analytics in detecting and preventing insurance fraud. By spotlighting the unique features and capabilities of SAS analytics tools, the webinar will underscore how insurers can leverage data-driven insights to proactively combat fraud, safeguard their operations, and bolster industry integrity.

Hear from industry thought leaders and receive practical guidance. Don't miss out on this invaluable opportunity to stay ahead of emerging threats and trends in the industry.

In this fireside chat webinar we will:

- Explore current trends influencing insurance fraud (e.g. digital transformation, consumer expectations, and organised fraud activities) and discuss how these trends shape fraud prevention strategies, highlighting areas of focus for industry stakeholders.

- Explore methods for enhancing customer trust and satisfaction whilst maintaining effective fraud detection processes and regulatory compliance

- Examine the role of SAS analytics in detecting and preventing insurance fraud. Highlight the unique features and capabilities of SAS analytics tools that enable insurance companies to stay ahead of evolving fraud tactics and emerging threats.

- Identify effective approaches, techniques, and tools for combatting fraud in the insurance sector, considering evolving fraud tactics and challenges.

NEWS

SPEAKERS

Simon Hyett

Contributing Editor

Insurance Asia

(Moderator)

Contributing Editor

Insurance Asia

(Moderator)

Simon is a highly experienced and well-regarded corporate host, moderator, commentator, business editor and narrowcaster. Having been in Singapore nearly 22 years, Simon has hosted hundreds of business events and travelled widely to present addresses, chair industry panels and produce events. Simon has a long history in business editing, covering myriad industry sectors including banking and finance, human resources, healthcare, luxury, retail, power and energy and ESG. He has held roles Group Editor, Managing Editor and General Manager for several business publishers (including now leading client The Charlton Media Group) before establishing his own communications practice Simon Hyett Media (formerly BOTR Communications) well over a decade ago.

Simon is a qualified lawyer, professional musician, entrepreneur and father to two fantastic teenage sons. He has been described as having an unhealthy relationship with world flags, geography and in particular, nation shapes. He is passionate about fairness, justice, corporate accountability, and humanity in business. Simon has sat on the Board of the Media and Publishers’ Association of Singapore, was the longest serving President of his sons’ international school community group and is a boardmember of the Australian Chamber of Commerce SME Committee. Simon is an eternal survivor, loves life, loves people’s stories both personal and in business and conducts all his hosting and moderating in a warm, human, energetic and infectiously positive manner.

For testimonials on Simon’s experience and style, please contact him at [email protected].

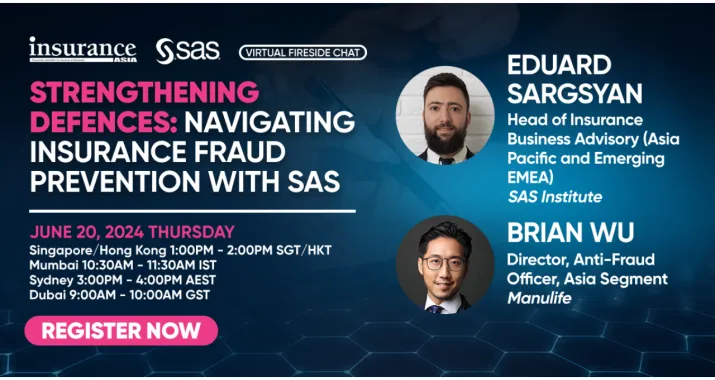

Eduard Sargsyan

Head of Insurance Business Advisory (Asia Pacific and Emerging EMEA)

SAS Institute

Head of Insurance Business Advisory (Asia Pacific and Emerging EMEA)

SAS Institute

Eduard has over 10 years of experience in Value, Business Case Driven Sales of data monetization and process automation projects in Insurance. Before joining SAS ASEAN Eduard worked in SAS CEMEA region and took part in more than 35 digital transformation projects for major insurers for the last 7 years. These projects have already earned to the insurers 100+ USD million in revenue. Eduard has accumulated a lot of practical expertise about using digital technologies to boost revenue in both General and Life Insurance.

The key focus of Eduard’s work is to help customers transform the data they collect into increasing scale, capitalization, and sustainability of their businesses. He assists insurance companies in finding growth areas in business processes & business models, formulating business cases and digital transformation strategies for data monetization initiatives, bringing high-tech projects to a specific financial & operational result.

Brian Wu

Director

Anti-Fraud Officer, Asia Segment

Manulife

Director

Anti-Fraud Officer, Asia Segment

Manulife

Brian Wu has extensive working experience in the Financial Institution on Financial Crime. During his 14 years’ time in HSBC, he had taken up multiple roles (both 1st and 2nd line) including Risk & Control, Compliance Advanced Analytics and complex Financial Crime investigation identifying transnational organized crimes in Asia. Understanding the customers’ digital footprints and identifying the abnormally from scattered data, Brian had led his agile team to move away from manual, rule based reactive detection model in today’s digital era. As detection lead time is much shorter than before, this new proactive approach allows the company to run the operation with much leaner resources but equally effective. Brian has brought this new proven approach to the insurance sector in Asia now and is working hand in hand with the business to build a preventive and detective Fraud management solution.

Agenda

AGENDA

*Subject to change

1:00 PM - 1:05 PM: Welcome Remarks

- Simon Hyett, Contributing Editor, Insurance Asia

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

1:05 PM - 1:35 PM: Panel Discussion

Moderator:

- Simon Hyett, Contributing Editor, Insurance Asia

Panelist:

- Eduard Sargsyan, Head of Insurance Business Advisory (Asia Pacific and Emerging EMEA), SAS Institute

- Brian Wu, Director, Anti-Fraud Officer, Asia Segment, Manulife

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

1:35 PM - 1:45 PM: SAS Speaking Session

- Eduard Sargsyan, Head of Insurance Business Advisory (Asia Pacific and Emerging EMEA), SAS Institute

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

1:45 PM - 1:55 PM: Q&A

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

1:55 PM - 2:00 PM: Closing Remarks

- Simon Hyett, Contributing Editor, Insurance Asia

- Eduard Sargsyan, Head of Insurance Business Advisory (Asia Pacific and Emerging EMEA), SAS Institute

For inquiries, reach us at

For more details, contact:

Insurance Asia Events Team

+65 31581386

SPEAKERS

Simon Hyett

Contributing Editor

Insurance Asia

(Moderator)

Contributing Editor

Insurance Asia

(Moderator)

Simon is a highly experienced and well-regarded corporate host, moderator, commentator, business editor and narrowcaster. Having been in Singapore nearly 22 years, Simon has hosted hundreds of business events and travelled widely to present addresses, chair industry panels and produce events. Simon has a long history in business editing, covering myriad industry sectors including banking and finance, human resources, healthcare, luxury, retail, power and energy and ESG. He has held roles Group Editor, Managing Editor and General Manager for several business publishers (including now leading client The Charlton Media Group) before establishing his own communications practice Simon Hyett Media (formerly BOTR Communications) well over a decade ago.

Simon is a qualified lawyer, professional musician, entrepreneur and father to two fantastic teenage sons. He has been described as having an unhealthy relationship with world flags, geography and in particular, nation shapes. He is passionate about fairness, justice, corporate accountability, and humanity in business. Simon has sat on the Board of the Media and Publishers’ Association of Singapore, was the longest serving President of his sons’ international school community group and is a boardmember of the Australian Chamber of Commerce SME Committee. Simon is an eternal survivor, loves life, loves people’s stories both personal and in business and conducts all his hosting and moderating in a warm, human, energetic and infectiously positive manner.

For testimonials on Simon’s experience and style, please contact him at [email protected].

Eduard Sargsyan

Head of Insurance Business Advisory (Asia Pacific and Emerging EMEA)

SAS Institute

Head of Insurance Business Advisory (Asia Pacific and Emerging EMEA)

SAS Institute

Eduard has over 10 years of experience in Value, Business Case Driven Sales of data monetization and process automation projects in Insurance. Before joining SAS ASEAN Eduard worked in SAS CEMEA region and took part in more than 35 digital transformation projects for major insurers for the last 7 years. These projects have already earned to the insurers 100+ USD million in revenue. Eduard has accumulated a lot of practical expertise about using digital technologies to boost revenue in both General and Life Insurance.

The key focus of Eduard’s work is to help customers transform the data they collect into increasing scale, capitalization, and sustainability of their businesses. He assists insurance companies in finding growth areas in business processes & business models, formulating business cases and digital transformation strategies for data monetization initiatives, bringing high-tech projects to a specific financial & operational result.

Brian Wu

Director

Anti-Fraud Officer, Asia Segment

Manulife

Director

Anti-Fraud Officer, Asia Segment

Manulife

Brian Wu has extensive working experience in the Financial Institution on Financial Crime. During his 14 years’ time in HSBC, he had taken up multiple roles (both 1st and 2nd line) including Risk & Control, Compliance Advanced Analytics and complex Financial Crime investigation identifying transnational organized crimes in Asia. Understanding the customers’ digital footprints and identifying the abnormally from scattered data, Brian had led his agile team to move away from manual, rule based reactive detection model in today’s digital era. As detection lead time is much shorter than before, this new proactive approach allows the company to run the operation with much leaner resources but equally effective. Brian has brought this new proven approach to the insurance sector in Asia now and is working hand in hand with the business to build a preventive and detective Fraud management solution.

Awards Highlights

Recent News

Experts highlight proactive insurance fraud prevention that combines tech, human expertise

Eduard Sargsyan and Brian Wu stressed that whilst advanced technology can increase efficiency, human expertise offers contextual knowledge to complement tech’s capabilities.

As advanced technologies like artificial intelligence...

Experts from SAS, Manulife offer insights on proactive insurance fraud prevention

Digital transformation may create new opportunities for fraudsters but it also empowers insurers with AI, data analytics, and other tools.

As the insurance industry navigates the complexities of digital transformation and...

Insurance fraud prevention with SAS: Strengthen today's strategies with tomorrow's solutions

Through insightful discussions, industry stakeholders will uncover effective strategies and tools, including SAS analytics, to combat evolving fraud tactics and regulatory challenges.

Insurance fraud remains a persistent thorn in...