Blue Cross APAC underwriting performance to stay ‘subdued’: S&P Global Ratings

Its combined ratio will stay above 100% through 2025.

Blue Cross’ (Asia Pacific) underwriting performance will remain subdued in the next two years, partly due to competition in the health insurance sector and expansion costs, forecasted S&P Global Ratings.

However, its efforts in pricing adequacy and efficient claims management for medical insurance should help narrow underwriting losses over the next three to five years.

Consequently, S&P Global Ratings expects the combined ratio to stay above 100% through 2025, indicating underwriting losses.

In terms of governance and risk management, Blue Cross aligns with standard practices in the Hong Kong property and casualty insurance industry.

Blue Cross maintains an exceptional liquidity assessment thanks to its significant holdings of cash and liquid assets.

Partnership with AIA

The stable outlook for Blue Cross is aligned with the assessment of AIA Group, and S&P Global Ratings anticipates that Blue Cross will maintain its SACP and strategic importance to AIA.

S&P Global Ratings believes that Blue Cross will continue to demonstrate competitive strength with healthy capital buffers over the next two years.

Blue Cross maintains robust capitalisation relative to its risk profile.

Whilst its modest capitalisation is susceptible to single-event risk, S&P Global Ratings anticipate support from the parent to uphold strong capital levels while fulfilling growth and expansion plans.

As of 31 December 2022, the insurer's regulatory solvency ratio was healthy at 260%, and it has no significant financial debt or heavy reliance on reinsurance.

ALSO READ: Blue Cross APAC earnings remain ‘marginal’ thanks to integration

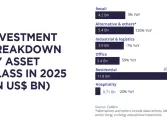

Blue Cross' investment strategy is relatively conservative, with a focus on fixed-income securities, money market funds, and substantial cash holdings, limiting exposure to high-risk assets. This conservative approach bolsters its capital strength.

In terms of competitive positioning, Blue Cross faces challenges in underwriting performance and growth due to its small scale and heavy concentration in health insurance.

In 2022, the company's market share remained low in Hong Kong's property and casualty insurance market, though it ranked higher in the accident and health insurance segment.

The insurer's portfolio is heavily weighted towards accident and health insurance.

Possible outliers

Looking ahead, S&P Global Ratings expects contributions from strategic partners, including the Bank of East Asia and AIA's Hong Kong agency network, to grow in the coming years, supporting its distribution channels.

However, the rating agency said a lower assessment could be imposed on Blue Cross if its partnership with AIA “weakens”. Scenarios would include if Blue Cross' earnings significantly decline, or if its capital position deteriorates substantially. An upgrade for Blue Cross is unlikely in the near future, but it could occur if its relevance to AIA increases, elevating its group status to the core.

Advertise

Advertise