Sun Life survey notes dip in insurance ownership claims

Only 8% of Singaporeans are planning more than 10 years ahead.

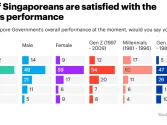

Insurance uptake in Singapore has declined as inflation continues to strain household budgets, according to the latest Sun Life Asia Financial Resilience Index.

The study, which surveyed 1,000 individuals in Singapore, found a 19% drop in the number of people with life insurance products and an 18% fall in those with investment-linked products compared to the previous year.

The findings show that inflation is affecting Singaporeans across income brackets, with 90% feeling the impact of rising prices and 42% reporting difficulty covering monthly expenses.

Even amongst high-income earners, 89% said they are affected by inflation, and 43% said it significantly impairs their ability to meet expenses.

As more households shift focus to daily financial needs, long-term financial planning is being deprioritised.

Only 8% of Singaporeans are planning more than 10 years ahead, and this figure drops to 5% for high-income respondents.

Meanwhile, 57% of all respondents have no financial plan extending beyond 12 months.

Sun Life Singapore CEO Christopher Albrecht said insurance remains a key tool for long-term financial resilience, especially amidst growing cost-of-living pressures.

He emphasised that the right insurance solutions can help individuals manage risk, preserve wealth, and build financial security despite market volatility.

Advertise

Advertise