Etiqa Philippines says rising costs may entail adjustments in premium pricing and risk management strategies

Although various influences linger, the country’s penetration rate must be put in focus.

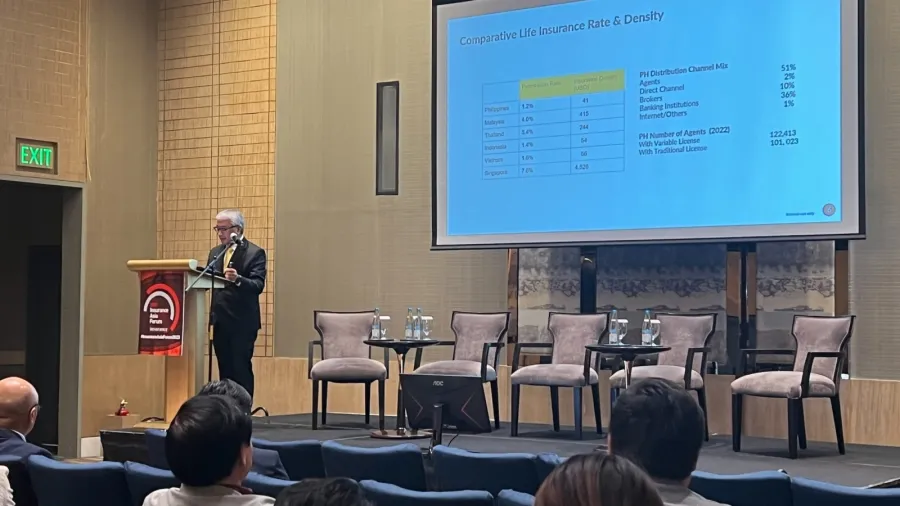

The Philippines’ insurance industry's landscape is in dire need of growth, whilst its low insurance penetration rate of 1.75% based on the total premium relative to the gross domestic product as of August poses a luring concern.

Despite the challenges, Rico T. Bautista, President and CEO of Etiqa Philippines and the President of the Philippine Life Insurance Association (PLIA) remained optimistic about the industry's potential.

Bautista, speaking at the 2023 Insurance Asia forum in Manila, said there are still prospects considering the insurance density and the percentage of Filipinos with insurance policies.

In 2022, the life insurance industry in the Philippines consisted of 34 companies, with 21 being local and 13 foreign-controlled.

Seven companies held composite licences, enabling them to offer both life and non-life insurance products. Variable life insurance policies accounted for 69% of the premium mix, while traditional life insurance products made up the remaining 31%.

Regarding distribution channels, the industry primarily relied on agents, with 51% of premiums being distributed through this channel. Banking institutions played a significant role, contributing 36% of premiums, while brokers accounted for 10%.

The remaining distribution occurred through other direct channels and the internet.

Unlocking new opportunities

Bautista also emphasised the importance of digitalisation in the insurance industry, noting that COVID-19 accelerated the adoption of digital technologies.

Etiqa Philippines partnered with leading platforms such as Lazada, Shopee, and G Cash to expand their reach and distribute insurance policies.

This collaboration resulted in the distribution of 15 million policies in the last year alone, earning Etiqa Philippines prestigious awards in the insurance industry.

Despite challenges, the life insurance industry has shown resilience, with positive growth in premium income and assets over the past five years.

Bautista highlighted areas where the industry was thriving, such as renewal performance, but also identified challenges, including policy contestability definitions, IFRS readiness, regulatory changes, and technological advancements.

Bautista concluded by reiterating the industry's commitment to digitalization and collaboration. He emphasised that companies didn't need to be fully digital to embrace technology.

Etiqa Philippines' focus on insurtech initiatives, teleconsultations, and strategic partnerships positioned them as a leader in the industry.

Outlook

Inflation is expected to have a broad impact on insurance costs, affecting everything from customer acquisition to claims processing. Rising costs may necessitate adjustments in premium pricing and risk management strategies.

The insurance industry is poised to undergo significant transformation, particularly in the health and protection product sectors, driven by advancements in technology. This may lead to the development of innovative insurance solutions that are more accessible and tailored to individual needs.

To explore new revenue streams and enhance their offerings, insurance companies are likely to engage in strategic partnerships and collaborations. These alliances can bring together complementary expertise and resources to better serve customers.

Sustainability is also becoming increasingly integral to the insurance business model. Insurers are expected to incorporate environmental, social, and governance (ESG) considerations into their operations, product offerings, and investment strategies to address the growing demand for responsible and ethical insurance solutions.

As the insurance industry navigates these trends and challenges, adaptation and innovation will be key to its continued growth and relevance. It's clear that the industry is on the cusp of significant changes, and companies will need to evolve to meet the evolving needs and expectations of customers and the broader market.

Advertise

Advertise