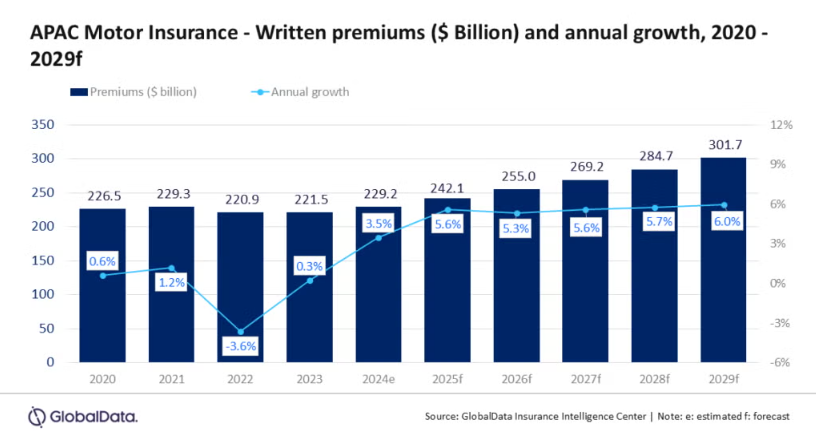

APAC motor insurance slated for 5.6% CAGR by 2029

China, Japan, Australia, South Korea, and India are top market performers.

Asia-Pacific’s motor insurance industry is forecasted to register a compound annual growth rate of 5.6% from 2024’s $229.2b to 2029’s $301.7b in terms of written premiums, revealed GlobalData.

The market’s growth will be driven by rising vehicle sales, particularly electric vehicles (EVs), regulatory reforms, and digital transformation.

China, Japan, Australia, South Korea, and India are expected to remain the top contributors, making up 92% of the region’s total motor insurance premiums in 2024.

Growth in 2025 alone is forecast at 5.6%, supported by EV subsidies, carbon reduction policies, tariff increases, and wider use of AI and digital tools across the insurance value chain.

Insurers are launching new EV-specific policies to address emerging risks as EV adoption accelerates.

Governments in markets like Taiwan, Singapore, and China are also introducing regulations tailored to EV insurance, further supporting demand.

In China, electric carmaker BYD entered the insurance market in May 2024 after acquiring a licensed insurer, allowing it to offer its own motor liability policies.

This reflects a broader trend of automakers integrating insurance services to expand distribution and improve customer retention.

New energy vehicles (NEVs) made up a third of vehicle sales in China in 2023.

As this share grows, insurers are using data analytics to build more accurate pricing models and underwriting standards for these vehicles.

However, tight regulation around pricing remains a challenge for insurers looking to improve margins.

Pay-as-you-drive (PAYD) motor insurance is gaining ground in South Korea, Singapore, Malaysia, and India.

These usage-based products offer lower premiums based on driving habits and distances travelled, which could ease consumer pushback on premium hikes.

Planned regulatory changes across the region are also expected to drive future demand.

Indonesia is preparing to mandate motor third-party liability insurance, whilst Malaysia is targeting a larger EV share by 2030.

Despite regulatory constraints, Swarup Kumar Sahoo, Senior Insurance analyst at GlobalData says moderate rate increases, underwriting discipline, and strategic partnerships will help sustain profitability as the market continues to evolve.

Advertise

Advertise