China’s major disease insurance benefit over 11m in 2023

The program aims to lessen the burden of medical expenses for its beneficiaries.

More than 11 million Chinese were able to benefit from the government’s major disease insurance in 2023, according to the National Healthcare Security Administration.

Authorities said the program eased the burden by around $1,117 on the average.

ALSO READ: China’s general insurance sector to surge 7.4% in CAGR by 2028

The major disease insurance is part of China’s three-tier healthcare security system, which also includes basic medical insurance and medical assistance. Its goal is to “mitigate the economic risks posed by medical expenditure.

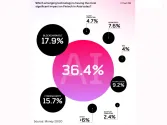

Around 1 billion Chinese who are under basic medical insurance are also covered by major disease insurance and are exempted from paying extra fees.

The minimum payment standard set for major disease insurance in a locality should be not higher than 50% of the per capita disposable income of residents in the previous year, and the reimbursement rate should not be lower than 60% of their medical bills.

The reimbursement rate for recipients of minimum subsistence allowances, those with special difficulties, and those who fall into or fall back into poverty should be five percentage points higher.

Advertise

Advertise