Double-digit premium growth lifts AIA to record value of new business in Q3

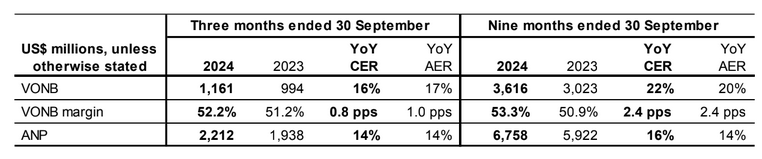

VONB is $1.16b in Q3, a 16% increase compared to Q2 2024.

AIA Group hit a record value of new business (VONB) in Q3 on the back of double-digit premium growth.

VONB is up 16% to a record $1.161b in the quarter that ended on 30 September 2024, the insurer’s latest financial report showed.

Annualised new premiums (ANP) grew 14% year-on-year (YoY) to $2.21b.

Margin reported on a present value of new business premium (PVNBP) basis remained stable compared with H1.

The total weighted premium income (TWPI) increased by 9% to US$10.3b in Q3.

AIA Group also achieved record VONB for the first three quarters of 2024, said Lee Yuan Siong, the group’s chief executive and president.

“The compounding of successive layers of profitable new business drives growth in earnings and cash generation, and underpins our confidence in delivering our financial targets,” Lee said, commenting on their financial performance for Q3 and 9M 2024.

In Q3, AIA logged VONB growth in 15 out of 18 markets.

Recruitment reportedly remained strong, with new agents and active agent numbers up 9% YoY compared with Q3 2023.

VONB from the insurer’s partnership distribution or bancassurance channels was up 16% during the quarter.

China business expansion

Lee said that the group is making “excellent” progress in mainland China. AIA Group had recently clinched approvals from local regulators to open branches in the Anhui and Shandong provinces.

AIA China achieved 9% VONB growth in Q3 on the back of growth in its agency and bancassurance channels. This is despite AIA withdrawing some of its products in China early ahead of an industry-wide repricing.

Agency VONB in China was 10%, based on a constant exchange rate basis with no recalculation of the 2023 comparatives.

AIA Hong Kong, meanwhile, delivered 24% VONDB growth.

AIA’s domestic customer segment in the city grew 28%, whilst its mainland China visitor (MCV) customer segment was up 20%.

However, VONB through its retail independent financial adviser (IFA) and broker channel declined, with the insurer blaming this on “intense competition.”

AIA’s Southeast Asian businesses collectively delivered 8% VONB growth in Q3.

Tata AIA Life, its joint venture in India, also returned to positive VONB growth during the quarter. It reportedly maintained its number one industry ranking in retail protection by sum assured.

About 0.04% of bonds held downgraded

AIA Group’s average credit rating of the fixed income portfolio as at 30 September 202, held in respect of policyholders and shareholders, reportedly remained stable compared with the position as at 30 June 2024.

The corporate bond portfolio has over 1,700 issuers and an average holding size of US$43m.

As of end-Q3, 2% of AIA’s total bond portfolio was rated below investment grade or not rated. This represents approximately $3.6b in value, similar to the amount as at end-Q2.

Approximately $72m of bonds, representing 0.04% of AIA’s total bond portfolio, were downgraded to below investment grade in Q3.

Advertise

Advertise