Global insurance M&A hits 15-year low in volume

The region’s deal volumes also fell by 20.7% YoY.

The insurance carrier mergers and acquisitions (M&A) landscape in the Asia Pacific (APAC) region has been resilient, despite a 20.7% year-on-year (YoY) decline to 23 deals in the first half (H1 2024). Whilst global deal volumes have slowed, the decrease has been less pronounced in APAC compared to the US and Europe, according to Clyde & Co.'s mid-year growth report update.

Several large-scale, cross-border transactions have taken place in the region, defying the trend seen elsewhere.

“Across Asia, the health and life sector remains the main driver of insurance M&A, with market players looking to expand distribution, gain scale and extend their reach across the value chain,” Joyce Chan, Partner at Clyde & Co. Hong Kong, said in the report.

“Contrary to global trends showing dampened M&A activity in the P&C market, the APAC region has proved to be resilient with solid M&A activity. In the Insurtech space, we also see insurers re-assessing their strategies in order to strengthen their positions in the market. APAC insurers are demonstrating greater interest in technology, which is in line with the global trends,” Chan added.

One notable deal was Sumitomo Life’s acquisition of Singapore Life, marking the largest international transaction in the region this year. Japanese insurers have continued to expand their regional presence, with major carriers broadening their footprints through acquisitions.

Across APAC, established carriers have also been active in acquiring operations in developing economies. Approximately 40% of the deals completed this year have been cross-border, reflecting a strategic focus on growth beyond domestic markets.

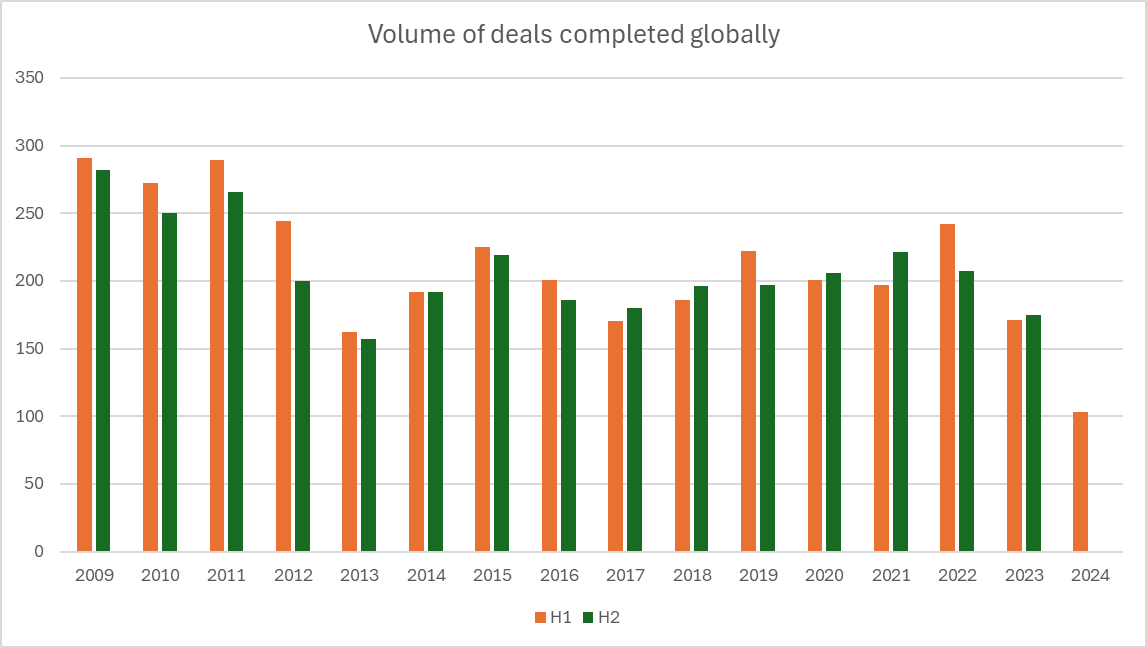

Globally, M&A activity recorded its lowest deal volume in 15 years, with only 103 deals completed in the first half of 2024, the Clyde & Co. report unveiled.

/Clyde & Co.'s

This follows a drop in deal activity throughout 2023, largely driven by inflation and interest rate reductions. In the first half of this year, many cash-rich carriers held onto capital due to high interest rates, further slowing the pace of mergers and acquisitions.

Additional factors contributing to the reduced deal volume include high pricing expectations from sellers and rising premiums required to integrate new technology systems, as the gap between outdated platforms and modern innovations grows. There has also been an increasing focus on securing talent, altering the dynamics of deal negotiations.

Despite the sluggish start, Clyde & Co's report suggests a potential rebound in M&A activity.

Eva-Maria Barbosa, Partner at Clyde & Co, indicated that larger transactions could drive the market in the latter half of 2024 and into 2025. She noted that whilst the overall number of deals may not significantly increase, major carriers could look to execute transactions spanning multiple jurisdictions, sometimes involving operations in eight to 10 countries.

Advertise

Advertise