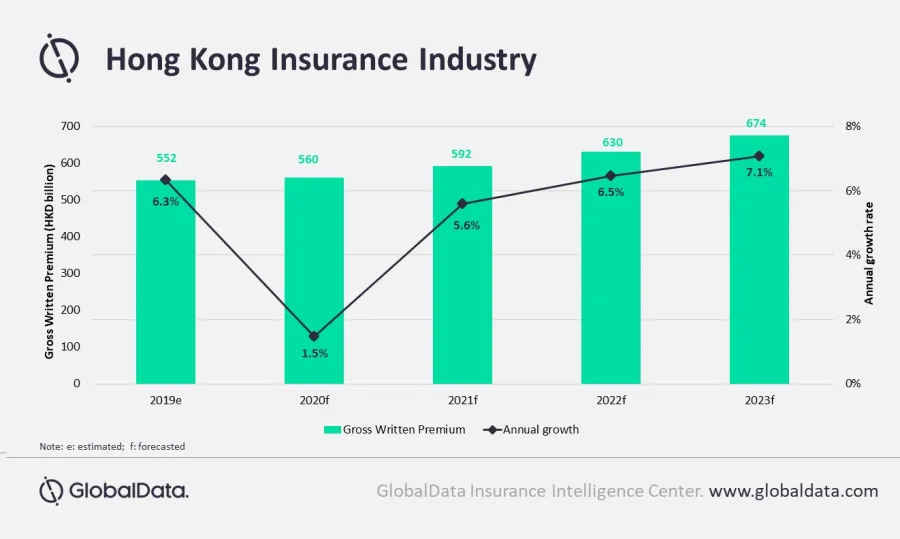

Hong Kong insurance premiums to grow 1.46% in 2020

This is barely a quarter of the 6.3% rise in 2019.

Hong Kong’s $66b insurance industry is set to register a 1.46% insurance premium growth in 2020, barely a quarter of the 6.3% expansion in 2019, reports data and analytics company GlobalData.

All growth prospects were adjusted down due to the effects of the ongoing pandemic. The life insurance segment, which accounts for 90% of Hong Kong’s insurance industry, is expected to grow by 1.51% in 2020 against the pre-COVID forecast of 6.7%.

Meanwhile, the non-life insurance segment, which accounts for less than 10% share of the insurance market, is estimated to grow by 1% in 2020 against the pre-COVID forecast of 4.4%.

Insurers face the risk of lower return on investments, especially those held in corporate bonds, due to the adverse economic impact by COVID-19.

The central bank’s benchmark interest rates declined from 1.65% at the end of March 2020 to 0.5% at the first week of June 2020, indicating pressure on returns.

Further, the life insurance business is expected to be adversely affected by the prevailing social unrest in the country, as significant part of the demand is based out of mainland China, noted Swarup Kumar Sahoo, insurance analyst at GlobalData.

To mitigate the impact of lockdown on business, insurers are accelerating the shift towards digital channels, noted Sahoo.

Manulife, Hong Kong’s fourth largest life insurer, recently set up virtual sales platform to enable customers to connect with agents online for product queries and transactions.

The regulatory authority is also issuing new licenses for digital-only life insurance companies.

“The over-dependence on life insurance business makes it difficult for insurers as they will have to grapple with lower sales, uncertain returns and rising claims. The resurgence in COVID-19 infection rates and possible re-imposition of lockdown restrictions could further derail recovery prospect of insurance business,” Sahoo concluded.

Advertise

Advertise