How will Malaysia’s general insurance market perform in 2025?

Pressures like new reciprocal tariffs from the US could impact future growth.

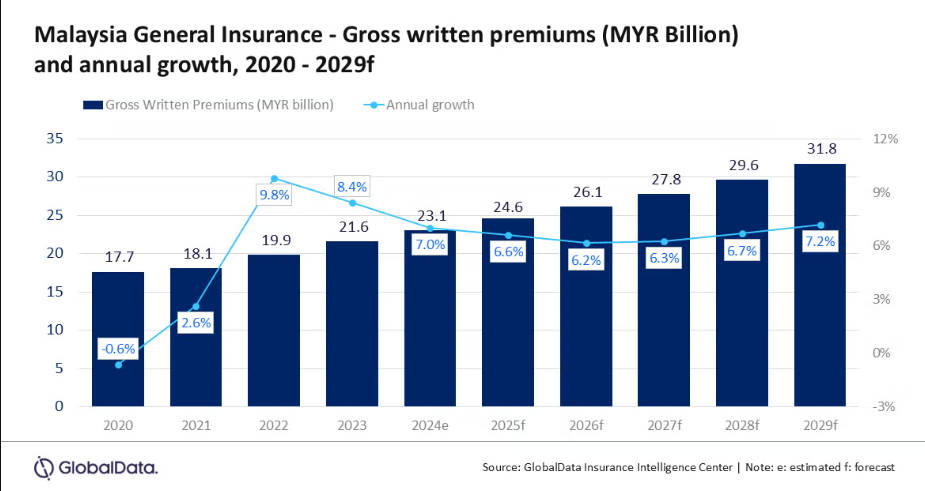

Malaysia’s general insurance industry is projected to expand at a compound annual growth rate (CAGR) of 6.6% from $5.5b in 2025 to $7.2b by 2029, based on gross written premiums (GWP), according to GlobalData.

The expected growth is driven by premium rate hikes, increased demand for natural catastrophe coverage, continued economic recovery, rising vehicle sales, and escalating healthcare costs.

In 2024, motor, property, and personal accident and health (PA&H) insurance made up 82.6% of the total general insurance GWP.

“Regulatory initiatives to develop the insurance market and increase insurance penetration will drive the growth of the general insurance industry in Malaysia. Additionally, the rising traffic accident rate and increasing frequency of natural disasters will support higher policy uptake and premium growth in the industry,” said Swarup Kumar Sahoo, Senior Insurance analyst at GlobalData.

The Bank Negara Malaysia’s Financial Inclusion Framework 2023–2026 aims to raise insurance and takaful penetration to around 5% by 2026, up from 4.4% in 2024.

Strategies under the framework include expanding microinsurance and microtakaful offerings and promoting digital insurance products.

To address rising health insurance premiums—some of which increased by over 50%—BNM implemented a cap of 10% annual increases for the next three years starting December 2024.

Meanwhile, the upcoming Risk-Based Capital 2 (RBC2) framework, set to begin in January 2027, is expected to improve industry resilience.

Motor insurance remains the largest line of business, projected to contribute 44.7% of GWP in 2025.

Growth in this segment is supported by increasing vehicle sales and road accidents, as well as rising demand for disaster-related vehicle coverage.

The Malaysian Automotive Association reported a 2.1% increase in vehicle sales in 2024 to 816,747 units.

Electric vehicle registrations surged 64%, making up 2.54% of total vehicle registrations.

Property insurance is the second-largest segment, with an expected 26.2% share of GWP in 2025.

It is forecast to grow 5.8% in 2025 following a 4.6% rise in 2024, driven by construction sector expansion and more frequent extreme weather, particularly floods.

PA&H insurance is the third-largest segment, forecast to account for 11.4% of GWP in 2025.

Growth will be supported by rising medical inflation, which hit 15% in 2024, and increasing healthcare demand.

“High healthcare costs heightened health consciousness among consumers, supporting the demand for health insurance policies. Premium rates will continue to increase in the presence of the aging society, rising non-communicable diseases, and a strained public healthcare system. PA&H insurance is forecasted to grow at a CAGR of 7.6% during 2025 to 2029,” Sahoo added.

Other lines, including financial, liability, and marine, aviation and transit insurance, are expected to comprise the remaining 17.7% of GWP in 2025.

Sahoo noted that whilst the market outlook remains positive, external pressures like new reciprocal tariffs from the US could impact future growth dynamics.

Advertise

Advertise