Insured losses to reach $1.08b in CrowdStrike fallout

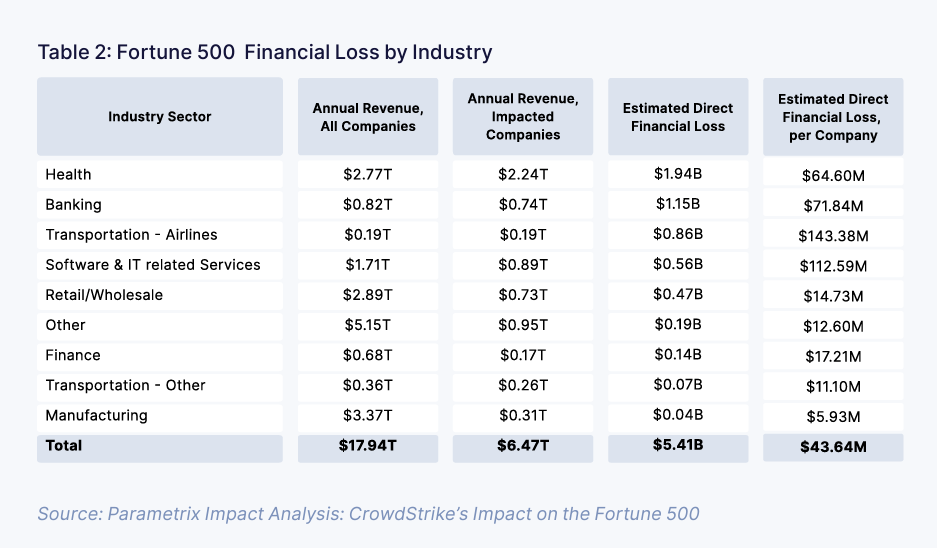

This is equivalent to about a fifth of the total financial loss of $5.4b.

The recent global CrowdStrike outage significantly impacted approximately 25% of Fortune 500 companies, causing insured losses to range between $0.54b and $1.08b, projected Parametrix.

Total insured losses represent about 10% to 20% of the total financial loss of $5.4b for the Fortune 500. The healthcare sector faces the highest losses of $64.6m. This was followed by banking ($71.8m) and airlines ($143.4m).

This event underscores the critical dependency of major corporations on cloud services and the systemic risks of such disruptions.

About 25% of Fortune 500 companies experienced disruptions due to the CrowdStrike outage, with the most heavily impacted industries being airlines, healthcare, and banking.

Notably, 100% of the transportation-airlines sector was affected. The software and IT-related services sector, excluding Microsoft, was less impacted, suggesting that insurers can better manage risk by diversifying portfolios to include industries that rely on different service providers.

Advertise

Advertise