Japan's Property Insurance to Hit $27b by 2028

However, a recovery is anticipated in 2024.

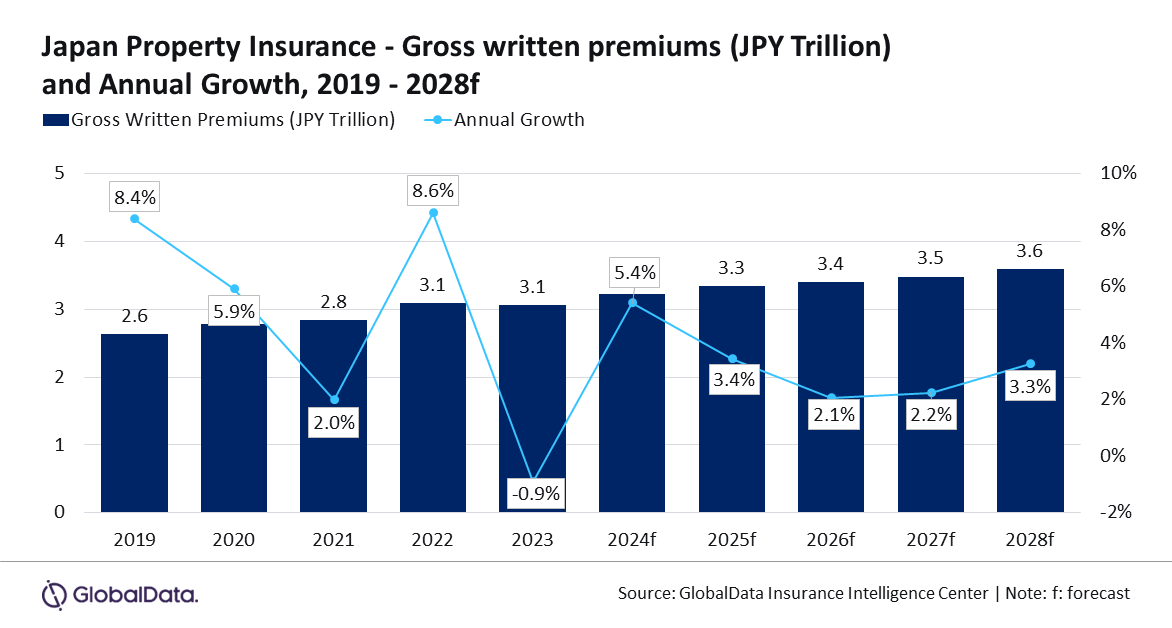

The property insurance sector in Japan is projected to bag $26.5b by 2028, garnering a compound annual growth rate (CAGR) of 2.8% from 2024 to 2028, revealed GlobalData.

The sector contracted by 0.9% in 2023, primarily due to insufficient underwriting of natural catastrophe (Nat-cat) policies as rising disaster-related claims strained insurers' profitability, according to GlobalData's Insurance Database.

However, a recovery is anticipated in 2024, driven by high demand for Nat-cat coverage and growth in the construction and energy sectors.

The frequency of Nat-cat events continues to reshape the market. Insured losses in 2024 began with the Noto Peninsula earthquake on 1 January, which triggered payouts totalling $579m by May.

Subsequent events included a magnitude 7.1 earthquake in Kyushu on August 8 and Typhoon Shanshan later that month, adding to insurers' burden. Fire and natural hazard insurance policies are expected to account for 84.7% of property insurance premiums in 2024.

Aarti Sharma, Insurance Analyst at GlobalData, attributes the market's resilience to increased risk awareness, inflation-driven premium adjustments, and insurers enhancing their retentions amid rising reinsurance costs.

The construction industry is a key driver. GlobalData projects the sector's output to grow at an annual average of 1.1% between 2025 and 2028, bolstered by renewable energy and commercial investments.

Government initiatives to raise renewable energy's share to 36% to 38% and nuclear energy to 20% to 22% by 2030 are also expected to stimulate property insurance demand, especially for infrastructure tied to clean energy.

In agriculture, automation driven by AI-equipped robots is reducing crop losses and claims on crop insurance, as Japan's ageing population accelerates the adoption of robotics for harvesting and yield management.

“Increasing technological advancements with the use of artificial intelligence (AI) and the Internet of Things (IoT) are also expected to support property insurance. Data integrations to enhance the decision-making process in pricing, underwriting, and risk management will aid in improving the response time and efficiency of property insurers,” Sharma added.

Despite recent challenges, Sharma said the market is poised for steady growth as insurers adapt to evolving risks and technological innovations.

Advertise

Advertise