Malaysia general insurance industry to reach $5.5b in 2026

The industry’s growth was boosted by strong performance in motor insurance.

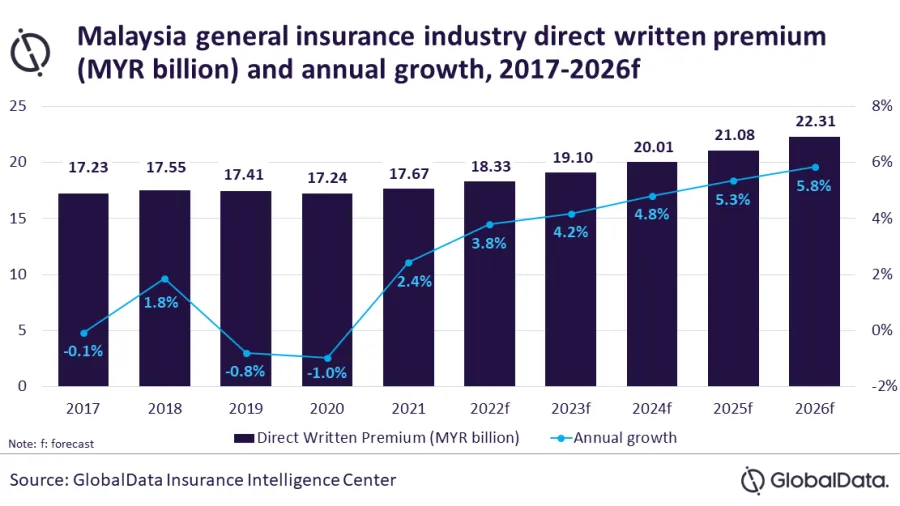

Malaysia’s general insurance industry is projected to reach $5.5b in 2026, growing at a compound annual growth rate (CAGR) of 4.6%, according to GlobalData.

The growth in the Malaysian general insurance industry will be supported by the increase in automobile sales as well as strong performance in property insurance driven by the expansion of construction activities in the country.

GlobalData Senior Insurance Analyst Rakesh Raj said that the Malaysian general insurance industry registered a growth of 2.4% in 2021 after declining in 2019 and 2020. Because of the economic recovery, it is expected to grow by 5.5% in 2022.

Going by segment, motor insurance was the largest general insurance line, accounting for 46.5% of the total DWP in 2021. After declining by 2% in 2021 due to COVID-19 lockdown restrictions and global automobile chip shortage, the motor insurance segment is expected to grow by 1.9% in 2022, driven by an increase in vehicle sales. Motor insurance is expected to grow at a CAGR of 3% from 2021 to 2026.

Property insurance, which was the second-largest general insurance line with a 25.4% share, grew by 12.4% in 2021, driven by increased construction activity. According to the Malaysian Ministry of Finance, the construction sector is expected to grow by 11.5% in 2022, driven by the strong pipeline of infrastructure, residential, and utility projects. As a result, property insurance is expected to grow at a CAGR of 7.9% from 2021 to 2026.

Meanwhile, personal accident and health (PA&H) insurance was the third-largest line, accounting for 11.1% of general insurance DWP in 2021. The Malaysian healthcare system is predominantly based on public health insurance whereas private health insurance is mostly sold as an add-on service.

“However, with rising medical costs, increased health awareness, and a gap in public healthcare coverage, the popularity of private insurance is increasing among the citizens. PA&H insurance is expected to grow at a CAGR of 4.5% during 2021 to 2026,” Raj said

Marine, aviation and transit (MAT), Liability, and Miscellaneous insurance accounted for the remaining 16.9% share in 2021.

“Malaysia’s general insurance penetration, as a percentage of GDP, in 2021 was 1.2%, which is slightly higher than the Asia-Pacific average of 1.1%. Recovery in the economy, increasing vehicle sales and a strong pipeline of construction projects are expected to support the growth of the Malaysian general insurance industry over the next five years,” Raj concludes.

You may also like:

Allianz General Malaysia launches bicycle insurance

EXCLUSIVE: The life-changing ‘crash’ of PGA Sompo’s CEO

COMMENTARY: Moving towards a “higher bottom line” in the insurance sector in Southeast Asia

Advertise

Advertise