Taiwan's general insurance sector to contract 1.7%

The sector is plagued by export and motor business downfalls.

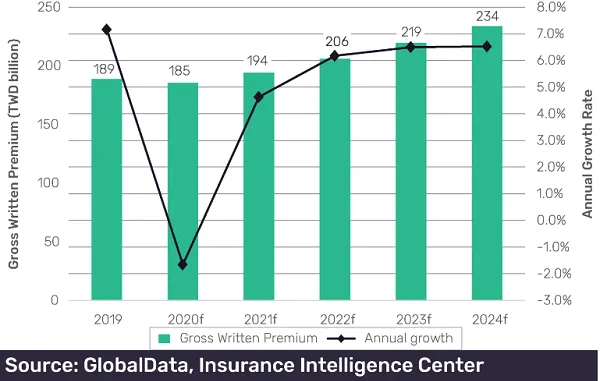

Taiwan’s general insurance industry will shrink 1.7% in 2020, the first time since the 2008 global financial crisis, according to a GlobalData report.

The sector is expected to grow at a CAGR of 4.4% from 2019 to 2024.

The coronavirus played a heavy role in the downfall as Taiwan’s export-dependent economy took a beating due to its reliance on China, analyst Shabbir Ansari explained. Auto production stalled and sales slowed down, hurting the motor insurance business which accounted for 53% of general insurance premiums in 2019.

Property insurance, which accounts for 19% of the market, is also expected to plunge this year. Lower property insurance premiums are on the horizon as housing sales in Taiwan’s six major cities declined by over 20% in May.

Moreover, aviation insurers face the possibility of refunding a share of premium collected due to a clause which offers premium adjustments if aircrafts are grounded for long periods of time, the report said.

On the brighter side, the sector is expected to recover in 2021 on the back of industries such as electronics and pharmaceuticals known for relatively steady growth.

Advertise

Advertise