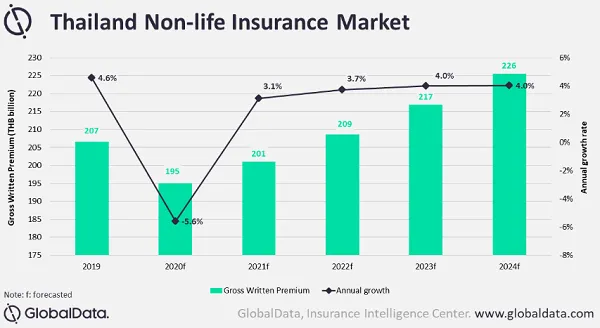

Thai non-life insurance segment to dwindle 5.6% this year

The motor insurance market will fall 6%.

Thailand’s non-life insurance market is feared to shrink 5.6% this year on the back of the COVID-led economic fallout, according to a GlobalData report.

The sector is projected to grow at a CAGR of 4.1% from 2020 to 2024.

The motor segment, which accounts for a lion’s share of 70% of non-life business, has been plagued by rising household debt, pressure on auto financing and recent movement restrictions which significantly hurt automobile sales in the country, said analyst Madhuri Pingali.

The segment is projected to contract 6% this year.

Property insurance, the second largest business line with 18% market share, will likely benefit from increased infrastructure investments as the government has allocated more than $9.52b (THB300) towards transport and public utility development projects. However, the segment is also projected to decline 4.1% due to muted commercial and retail construction activities.

Advertise

Advertise