Top 20 APAC insurers average 8.2% in premium growth – GlobalData

Rate hikes and macroeconomic uncertainty remain a concern for APAC insurers.

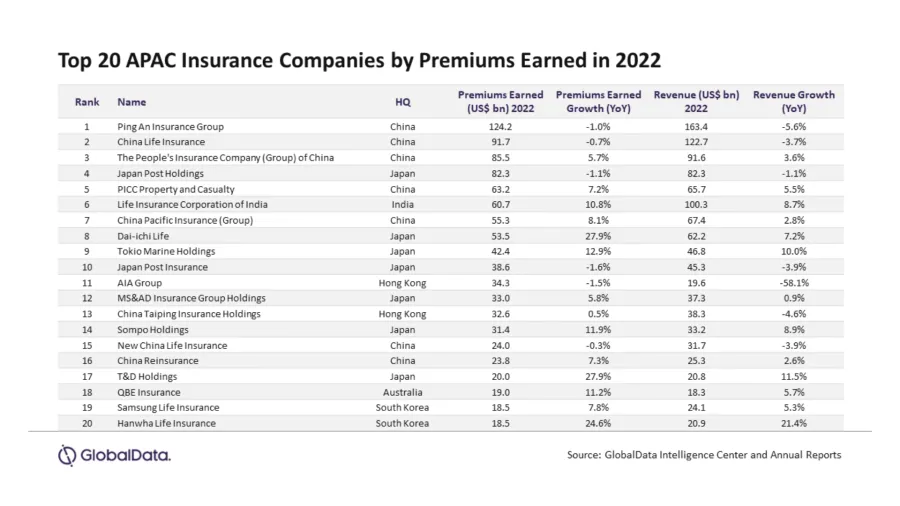

In 2022, the top 20 public insurance companies in the Asia-Pacific (APAC) region continued their positive momentum, riding the wave of increased insurance awareness post the COVID-19 pandemic and economic recovery in most markets, shared GlobalData.

On average, their premium earned* saw an 8.2% growth, accompanied by a slight 0.7% increase in total revenue.

Among these top 20 insurers, 15 witnessed year-on-year (YoY) growth in premiums earned during 2022. The standout performers included Dai-ichi Life, T&D Holdings, and Hanwha Life Insurance.

“In 2022, roadblocks for insurers came in the form of IFRS 9 implementation and risk-based capital regulations, the translation of ESG/net-zero factors into investment approaches, and the establishment of viable hedging strategies in the face of elevated expenses and restricted access to hedging instruments. But they sailed through commendably,” expressed Murthy Grandhi, Company Profiles Analyst at GlobalData.

Dai-ichi Life's 17.6% increase in premium earnings was propelled by policy reserve reversals from reinsurance transactions aimed at minimising market risks.

T&D Holdings experienced an 11.5% rise in revenue, driven by a 7.6% growth in insurance premiums from Taiyo Life, a marginal increase of 0.3% from Daido Life, and a 94.7% surge from T&D Financial Life. Positive investment returns also contributed to this growth.

Hanwha Life Insurance saw a substantial 21.4% boost in revenue, attributed to a 26.3% expansion in premium income, led by increased general protection premiums and favourable investment yields.

ALSO READ: Unrealised losses to fly by top 20 reinsurers: S&P Global

However, Japan Post Insurance and AIA Group faced slight declines in earned premiums, with reductions of 1.6% and 1.5% respectively, leading to an overall dip in revenue.

Japan Post Insurance's drop in both insurance premiums and investment income resulted in a 3.9% decline in revenue.

AIA Group's total weighted premium income decreased by 1.9%, primarily due to a 5.9% reduction in premiums from the Thai market.

“After a prolonged period of low rates, insurers now face potential impacts of rate hikes and macroeconomic uncertainties. These considerations affect product design and capital allocation. The first half of 2022 saw unexpected challenges, with negative returns in equity and fixed-income markets, and significant currency depreciation against the US Dollar. Despite these issues, the Asia-Pacific insurance market remains attractive globally.” said Grandhi.

Advertise

Advertise