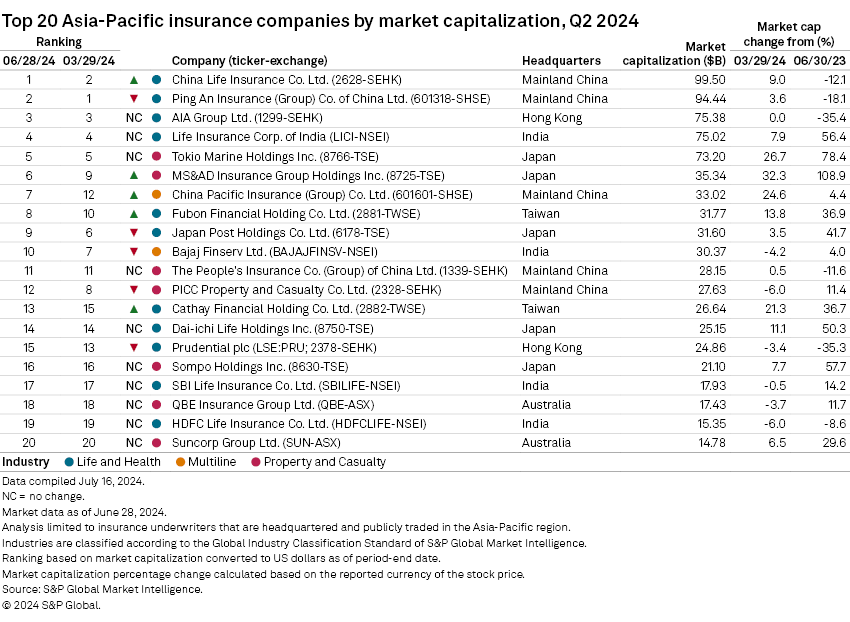

Top APAC insurers see market cap growth of Q2 2024

China Life Insurance led with a 9% growth during the period.

In the second quarter (Q2 2024), five of the 20 largest public insurers in Asia Pacific experienced sequential growth in their market capitalisations, according to an S&P Global Market Intelligence analysis.

China Life Insurance overtook Ping An Insurance (Group) of China to become the largest insurer in the region by market capitalisation.

China Life's market cap increased by 9% to $99.50b, whilst Ping An's grew by 3.6% to $94.44b.

Speculations over delayed repayments from Ping An’s trust business on a property-linked investment slightly impacted its stock performance.

Hong Kong-listed AIA Group, Life Insurance Corp. of India, and Japan's Tokio Marine Holdings held their positions at third, fourth, and fifth, respectively.

Japan-based MS&AD Insurance Group Holdings Inc. saw the largest market cap increase of 32.3%, rising to $35.34b, moving it from ninth to sixth place.

Tokio Marine also posted a strong 26.7% increase to $73.20b, benefiting from better-than-expected financial guidance and plans to unwind cross-shareholdings.

China Pacific Insurance (Group) Co. Ltd. and Fubon Financial Holding both entered the top 10, with China Pacific rising from 12th to 7th and Fubon from 10th to 8th.

Cathay Financial Holding moved up to 13th from 15th, with a 21.3% increase in market cap to $26.64b.

MS&AD and Tokio Marine also posted the highest total returns for the quarter at 31.9% and 27.7%, respectively. In contrast, Bajaj Finserv was the only top 10 insurer by market cap to record a negative total return of 3.3%.

Advertise

Advertise