Vietnam general insurance industry to reach $3.5b in 2026

Natural disasters and growing compulsory insurance classe is boosting the industry.

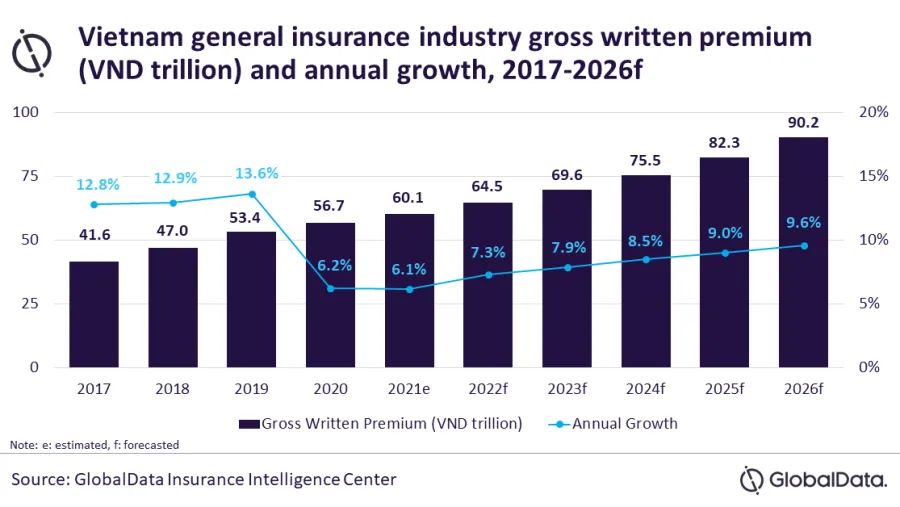

Vietnam’s general insurance industry will reach $3.5b in 2026, growing at an compound annual growth rate (CAGR) of 8.5% in terms of gross written premiums, according to a report by GlobalData.

The growth of the Vietnamese general insurance industry will be supported by strong economic recovery, increased frequency of natural disasters, and growing compulsory insurance classes.

Global Data Senior Insurance Analyst Shabbir Ansari said that Vietnam’s economy is expected to grow at 7.3% in 2022, following slowdown in 2020 and 2021, driven by strong government fiscal measures and growing manufacturing sector. The economic growth will support general insurance industry growth, which is expected to grow by 7.3% in 2022.

Personal accident and health (PA&H) insurance was the largest general insurance line, accounting for a 32.2% share of the GWP in 2020. The segment grew by 5.1% in 2020 driven by increased consumer awareness due to COVID-19, growing middle-class population, and rising medical costs.

The GlobalData report said that nearly 90% of the Vietnamese population is covered under mandatory public health insurance. However, a gap in coverage due to rising medical costs and disparity in the quality of public healthcare services have supported the demand for private insurance. Almost 7% of the population currently avails of private health insurance in the country. PA&H insurance is expected to grow at a CAGR of 8.2% during 2021-26.

Meanwhile, motor insurance was the second-largest line, accounting for 30.5% of general insurance GWP in 2020. The segment grew by 6.3% in 2020, driven by the recovery in motor vehicle sales. Motor insurance is expected to grow at a CAGR of 8.0% during 2021-2026.

Property insurance was the third-largest segment with 24.8% GWP share in 2020. With storms and other calamities frequently occurring in the country, there is a growing demand for natural catastrophe insurance.

In addition, over the last couple of years, the government has added new products to increase the ambit for compulsory construction insurance. For instance, in June 2020, the government passed a law mandating the construction contractors to purchase insurance for construction workers working on sites and civil liability insurance for third parties.

Another regulation on mandatory fire and explosion insurance came into effect in December 2021. It creates a transparent and unified legal framework for insurers and supports insurance growth. Property insurance is forecasted to grow at a CAGR of 9.0% over 2021-2026.

Marine, aviation and transit (MAT), Liability, and Financial lines insurance accounted for the remaining 12.5% share.

“Vietnam’s economic growth looks strong over the next five years as it aims to become a high-income economy by 2045. Economic growth and favourable regulatory policies will support the growth of the Vietnamese general insurance industry.” Ansari said.

Advertise

Advertise