Thai general insurance to hit $9.1b in 2019

Gross written premiums reached a CAGR of 3.1% between 2014 and 2018.

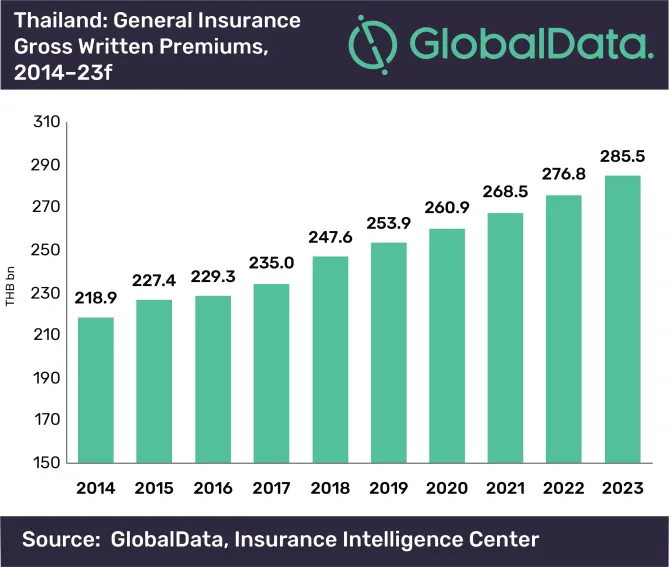

Thailand’s general insurance sector is poised to hit $9.1b (THB285.5b) this year from $7.7b (THB247.6b) in 2018, according to a GlobalData report.

Gross written premiums achieved a compound annual growth rate (CAGR) of 3.1% between 2014 and 2018, with motor, property, and personal accident and health insurance comprising more than 90% share last year. Motor insurance held the largest at 55%.

However, profitability is under pressure in the motor insurance sector as loss ratio surged to 65.3% last year from 57.8% in 2014 due to market competition but operational losses may lessen pricing.

Against the threat of economic slowdown due to international trade conflicts and currency appreciation, insurers are turning into telematics and usage based insurance for efficiency. Bangkok Insurance was the first to launch telematics in 2015, while Claims Di has offered solutions in automatic claims processing.

Advertise

Advertise