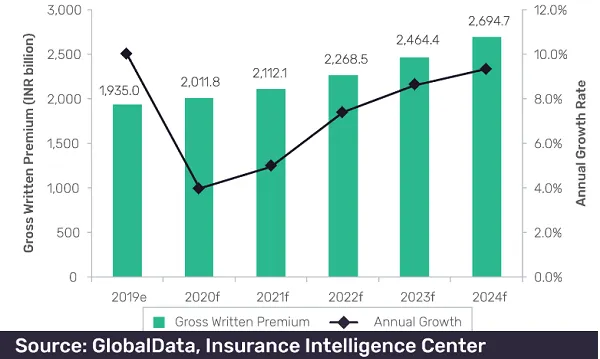

India's general insurance sector to decelerate 4% in 2020

Sector growth has been adjusted at a CAGR of 6.2%.

India’s general insurance sector will stagnate this year by 4% compared to 10% in 2019, according to a GlobalData report.

Sector growth has been adjusted in the backdrop of the pandemic, at a compound annual growth rate (CAGR) of 6.2% from 2019 to 2023. The economic slowdown will weigh down on premium collections in the segment, said analyst Pratyushka Mekala.

Downtrends in key sectors such as auto, manufacturing and construction will contribute to mode declines as they account for more than 47% of general insurance premiums in 2019.

A similar slowdown is seen in construction and real estate where demand has been slashed by 30% during Q1 2020. Contraction in these sectors is expected to result in the lower collection of new business premiums in the property insurance line of business, the report said.

Advertise

Advertise