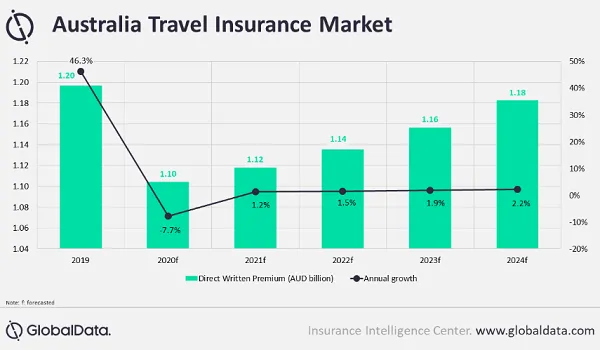

Australia's travel insurers to contract 7.7% in 2020

The return of movement restrictions will haunt the sector.

Australia’s travel insurance segment will shrink 7.7% this year on the bank of the pandemic, a sharp decline from the 46.3% growth recorded in 2019, a GlobalData report showed.

GlobalData has revised its forecast for the segment to a CAGR of an abysmal 0.2% from 2019 to 2024. The re-imposition of movement restrictions after a resurgence of COVID-19 cases in the country will adversely affect the industry, noted analyst Deblina Mitra.

International travel is currently restricted until 17 September, with flag carrier Qantas already announcing a freeze in all international flights - except for a few to New Zealand - until March 2021.

Moreover, domestic tourism offers limited opportunities as several Australian states and territories are set to open gradually for domestic tourism starting Q3.

Insurers are also bracing for refunds on planned trips and flights, despite clauses in these policies on the exclusion of both epidemics and pandemics. Insurance Australia and Allianz are providing full refunds for policies falling in the lockdown period, likely putting more pressure on the industry profitability.

Advertise

Advertise