Australia general insurance investment income drops by 76.3% in 2021

However, industry profit still increased to $1.24b compared to $43.77m in 2020.

Australia’s general insurance industry experienced a huge drop of 76.3% in its investment income on the back of unrealised losses on interest bearing investments, which resulted from increases in bond yields for the year ended 31 December 2021, according to data from the Australian Prudential Regulation Authority (APRA).

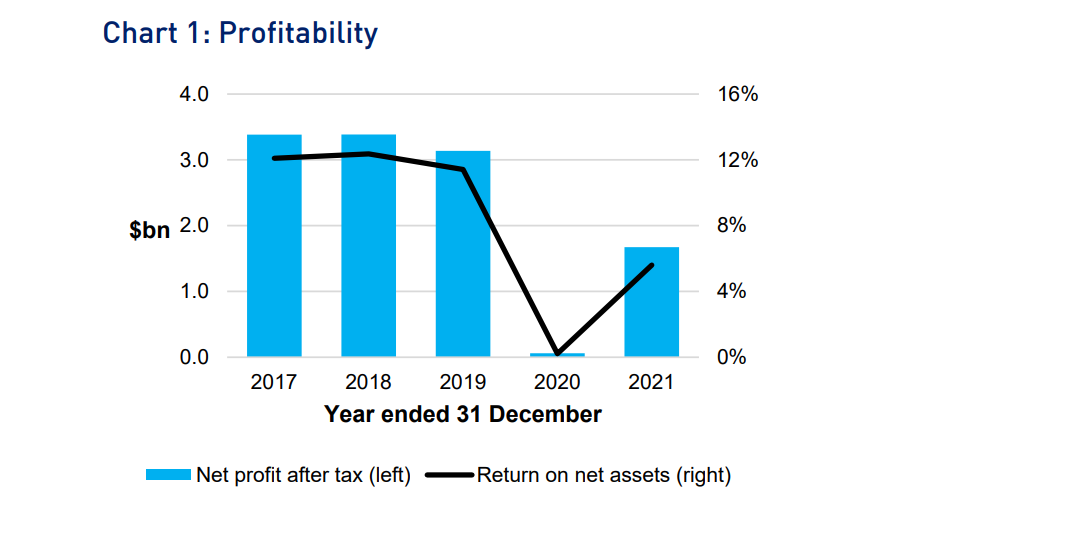

Despite that, the industry still maintained an increase in net profit after tax of $1.24b (AU$1.7b) from $43.77m (AU$60m) in 2020. Return on net assets increased by 5.4 percentage points to 5.6% in 2021 from 0.2% the year before.

Gross incurred claims costs decreased 18% during the year. Lower gross claims costs were reported in the Householders class of business due to a lower incidence of natural catastrophe events, and in the Reinsurance class of business.

For the Fire and Industrial Special Risks (ISR) class, gross claims costs were comparatively lower due to the prior year one-off impact of large claims provisions raised by insurers for Business Interruption insurance claims. Domestic Motor claims costs also increased in the year reflecting higher levels of motor vehicle usage when compared to the prior year.

You may also like:

Australian private health insurers rallies in 2021 with 229.3% surge in profits

India’s $8b IPO plans could go under review amidst Russian-Ukraine crisis

Surer backs new professional indemnity insurance in tripartite agreement

Advertise

Advertise