South Korea life insurance industry to reach $117b in 2026

Its growth will be driven by product innovations by insurers.

South Korea’s life insurance industry will reach $117b in 2026 boosted by product innovations by insurers according to a report by global data and analytics firm GlobalData.

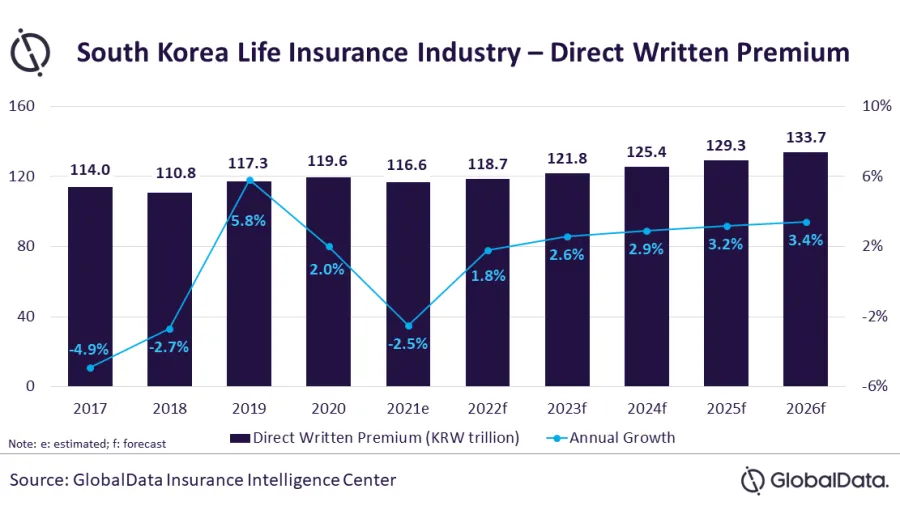

The industry is projected to grow at a compound annual growth rate (CAGR) of 2.8% from $100.4b in 2021 to $117b in 2026, in terms of direct written premiums (DWP).

According to GlobalData insurance analyst, Manogna Vangari, growth will be driven mostly by product innovations as insurers look for ways to reduce the impact of persistent low-interest rates and adverse demographic trends.

“A saturated market, an ageing society, and low fertility weighed down on life insurance growth during 2017-2020. Demand for whole life and endowment products also suffered due to low-interest-rate and higher capital requirements that forced insurers to limit the sale of such products,” Vangari said.

Vangari said they expect insurers to engage in product enhancements such as the introduction of low-cost short-term life insurance products for a period of one year with a coverage of up to KRW50.0 million ($43,694.2) and ease of sales via online channels to drive growth.

“Economic growth coupled with positive regulatory developments is expected to steer steady growth in the life insurance industry in South Korea over the next five years," Vangari said.

You may also like:

Premiums up, investments down in Australia’s general insurance industry

No man left behind: How insurtech is solving the underinsurance mess

Advertise

Advertise