Agencies, bancassurance takes largest slice for life insurance distribution in China

They account for 60.1% and 30% of the share in new business DWP in 2021.

Agencies and bancassurance remain the main channels of life insurance distribution in China and are predicted to grow at 2.2% and 3.9%, respectively according to a report by GlobalData.

Agencies account for 60.1% of new business direct written premiums (DWP) in 2021 whilst bancassurance takes about 30% of the slice of the market last year.

“Agencies are the main distribution channel for whole life insurance products, which accounted for 75% of life insurance DWP in China in 2021. Over 85% of high net worth (HNW) investors in China prefer life insurance in their inheritance planning, which is one of the main drivers of whole life insurance. The affluent population is expected to grow at an average annual growth of 9% over the next five years, boosting the demand for life insurance,” Deblina Mitra, Senior Insurance analyst at GlobalData said.

ALSO READ: India insurance regulator pushes easing of capital requirements

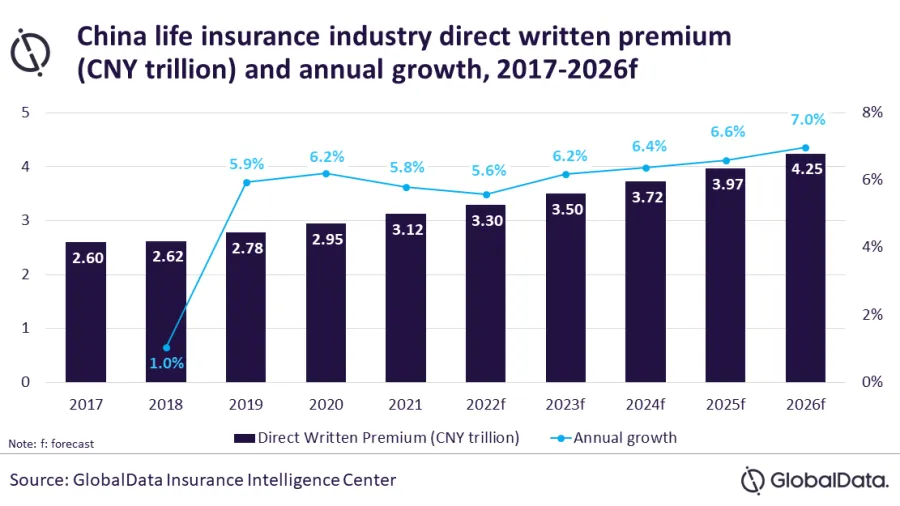

GlobalData predicts that the Chinese life insurance industry is set to grow at a compound annual growth rate (CAGR) of 6.3% from $484.4b (CNY3.1t) in 2021 to $665.6b (CNY4.25t) in 2026, in terms of DWP, supported by a recovery in the agency distribution channel and product innovations that address changing demographic requirements.

The boost in the life insurance industry in the country benefitted from the growing demand for personal accident and health (PA&H) insurance, driven by a rise in private healthcare facilities and disposable income. Life PA&H insurance occupied a 24.5% share of the DWP in 2021, with a CAGR of 13.8% during 2017 to 2021.

Hybrid insurance products, which combine healthcare and protection with savings, have also gained prominence in the country.

“Whole life and annuity insurance with riders, such as critical illness and accident, are the other examples of hybrid insurance products in China. The large middle-income population, which is expected to reach 90% by 2030, and the aging demography in China are the key consumers of these products,” Mitra said.

In April 2022, China witnessed the rollout of individual private pensions, as part of the third pillar of pension, to address income challenges faced by the aged population. The third pension pillar will allow individuals to contribute up to $1,872 (CNY12k )annually, which will be tax exempted and can be invested in products such as commercial endowments from life insurers.

“The current pension system with state pension covering 70% of the population and voluntary employee pensions is deemed inadequate to fully support China’s retirement requirements. The new pension plan has opened an untapped opportunity for insurers,” Mitra said.

“The life insurance industry in China is expected to weather the ongoing economic slowdown caused by frequent lockdowns and will expand over the next five years, aided by an influx of foreign capital.”

Advertise

Advertise