China's insurers adjust risk control amidst lower returns

P&C insurers’ underwriting margins may shrink further.

Insurers in China are likely to face increased operational challenges as they tighten risk control systems in response to declining returns, according to S&P Global Ratings.

Closer collaboration between insurers and the government is expected to bolster China’s social safety net, including through the expansion of inclusive insurance offerings.

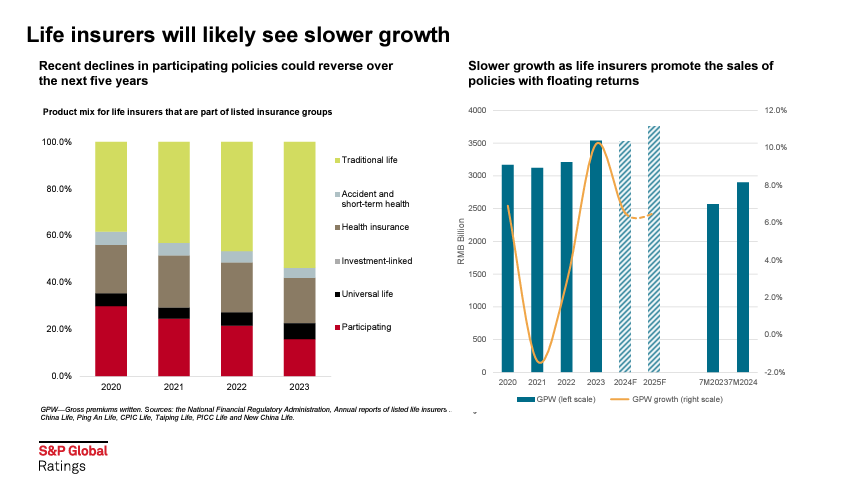

Life insurers are projected to experience slower growth as they shift towards floating-return policies to mitigate asset-liability mismatches.

For property and casualty (P&C) insurers, underwriting margins may shrink further as the sector assumes more catastrophe protection to meet national demands.

Advertise

Advertise