More than a third of consumers warm to AI in insurance claims

Markets like Australia showed the least enthusiasm.

Global consumers are increasingly open to engaging with artificial intelligence (AI) for their insurance needs, including in claim processing, according to a recent survey by GlobalData.

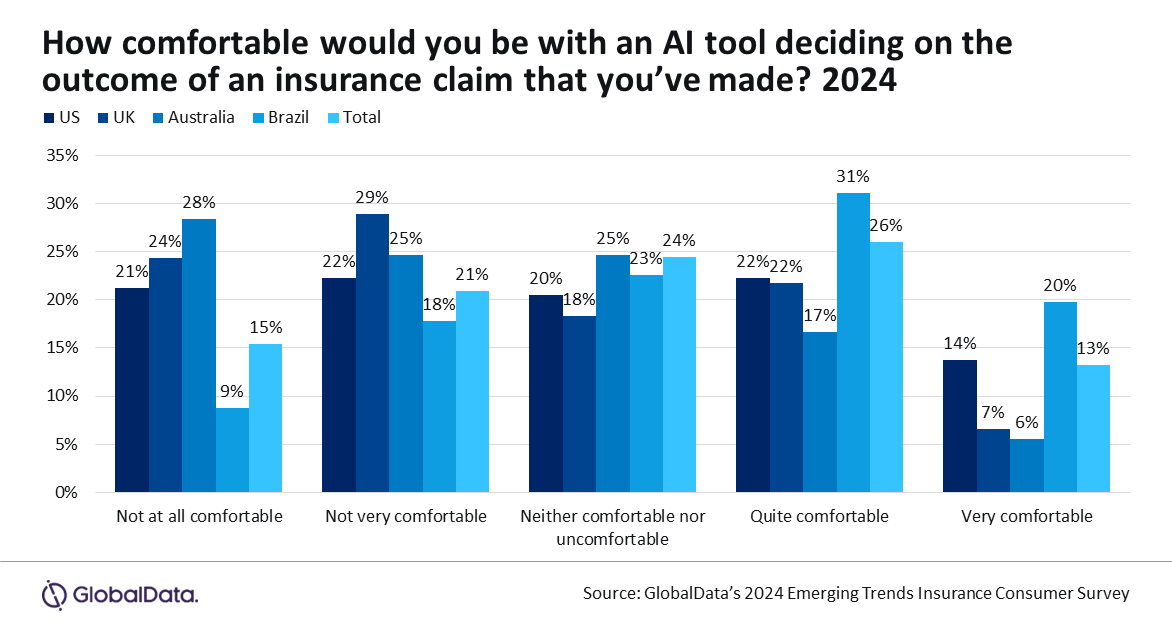

The "2024 Emerging Trends Insurance Consumer Survey (Q3)" revealed that 39% of respondents feel comfortable with AI tools determining the outcome of their insurance claims, highlighting the growing role of technology in the industry.

Ben Carey-Evans, Senior Insurance analyst at GlobalData, emphasised the significance of AI in the sector.

“AI is the leading technology theme within the insurance industry at the moment and will feature heavily in our upcoming conference. The survey data highlights that a significant proportion of consumers in leading countries around the world are prepared to interact with AI tools,” Carey-Evans said.

“Well over a third (39%) were comfortable with using AI in the claims process, which emphasises that insurers, which successfully introduce it will see strong usage from customers and stand out from their competition,” Carey-Evansey added.

Whilst global consumers show a growing willingness to interact with AI, the level of comfort varies by country.

Carey-Evans noted that insurers need to be mindful of regional differences when introducing AI-driven solutions. However, even in markets like Australia, which showed the least enthusiasm, more than 20% of respondents were open to using AI for insurance claims.

The survey, conducted across 11 countries, involved 5,520 respondents and reflects the increasing integration of AI and other technologies, such as the Internet of Things (IoT), in the insurance industry.

Advertise

Advertise