Investors told to buy and hold: AIA

Short-term market events should not distract one’s investment goals in the long run.

People should invest in the long term, putting their money in portfolios that can withstand market fluctuations and potential downturns, according to an insurance CEO.

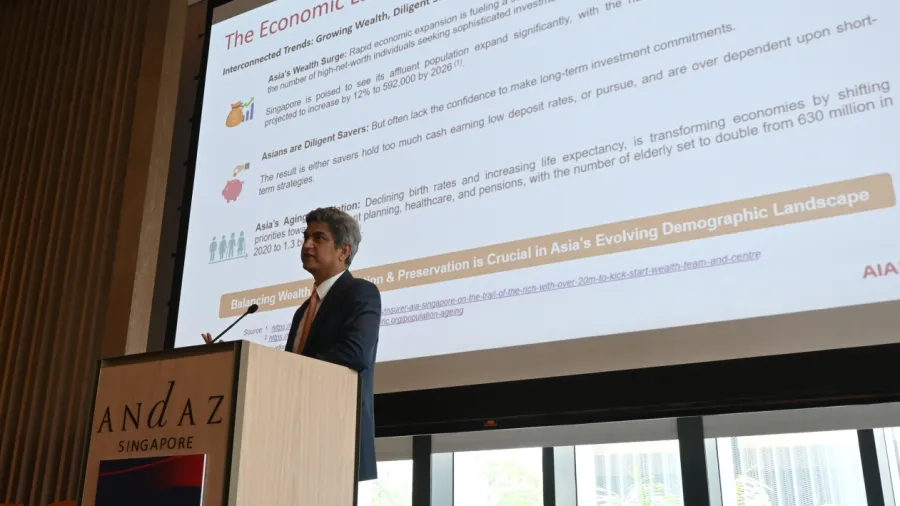

Short-term market events such as minor interest rate cuts or increases by central banks often dominate headlines and distract one’s bigger, long-term investment goals, Shrikant Bhat, CEO at AIA Group’s Investments Linked and Pension Business, told a recent Asian Banking & Finance and Insurance Asia Summit in Singapore.

These short-term fluctuations are unlikely to affect investors planning for their retirement decades ahead, he added, citing the US Federal Reserve’s rate cut in September as an example. Markets speculated days ahead whether it would be a 25 or 50 basis-point cut.

“Now think about it — if you're thinking about your retirement 10 or 20 years from now, does it really matter if it's 50 or 25 basis points?” he asked.

“Think about Russian sanctions or the pandemic — these are events you have to take into account,” Bhat said. “But you can't expect the customer to analyse them, so you want to handle that as an investment professional.”

Clients normally want to be assured that their investment income would not get eroded by rising prices over time. They also want to ensure that they are not missing out.

Bhat said relationship managers should focus on a customer’s investment objectives and build a portfolio to meet those requirements.

His emphasis on long-term investing comes from decades of experience, where he has seen wealth managers and clients focusing too much on quarterly results, often at the expense of broader financial security.

Investors and wealth managers especially should look at the big picture and the entire investment ecosystem. To do that, they need to have global expertise.

Bhat said AIA has transformed what started as a theoretical exercise into a product designed with two objectives.

“One, for retirement, so that it accumulates for the customer and eventually starts de-accumulating, providing income,” he said.

“The second is for legacy, so customers can accumulate money and leave it for the next generation.”

He said these portfolios have performed well given AIA Singapore’s five-year track record.

More than 60% of Singaporeans face an uncertain future by failing to prioritise retirement planning, with 92% relying on bank savings too much, according to AIA data. Most Singaporeans, who have the longest life expectancy in the world at 84.8 years, plan to retire at 60, but 66% underestimate the retirement income they need by at least $967 a month.

Bhat said the company alone does not have the power to change the market. Practitioners should consider the impact they wish to leave on consumers and the industry by thinking beyond merely engaging with customers and selling products, he added.

Advertise

Advertise