Wealth and retirement products lift Singapore insurers’ premiums

The Top 50 Insurance 2024 rankings show recovery from the 2023 downturn.

Singapore’s insurance industry rebounded in 2024, with gross premiums rising 10.67% year-on-year as insurers expanded beyond traditional protection products into wealth, investment and retirement solutions.

Both the life and general insurance segments posted annual growth after a weak performance a year earlier. Life insurance premiums climbed 10.93%, whilst general insurance premiums rose 1.61%, according to data compiled by the magazine.

This reversed a 9% contraction in 2023, when softer demand for life insurance and a preference for fixed deposits weighed on premiums amidst elevated interest rates.

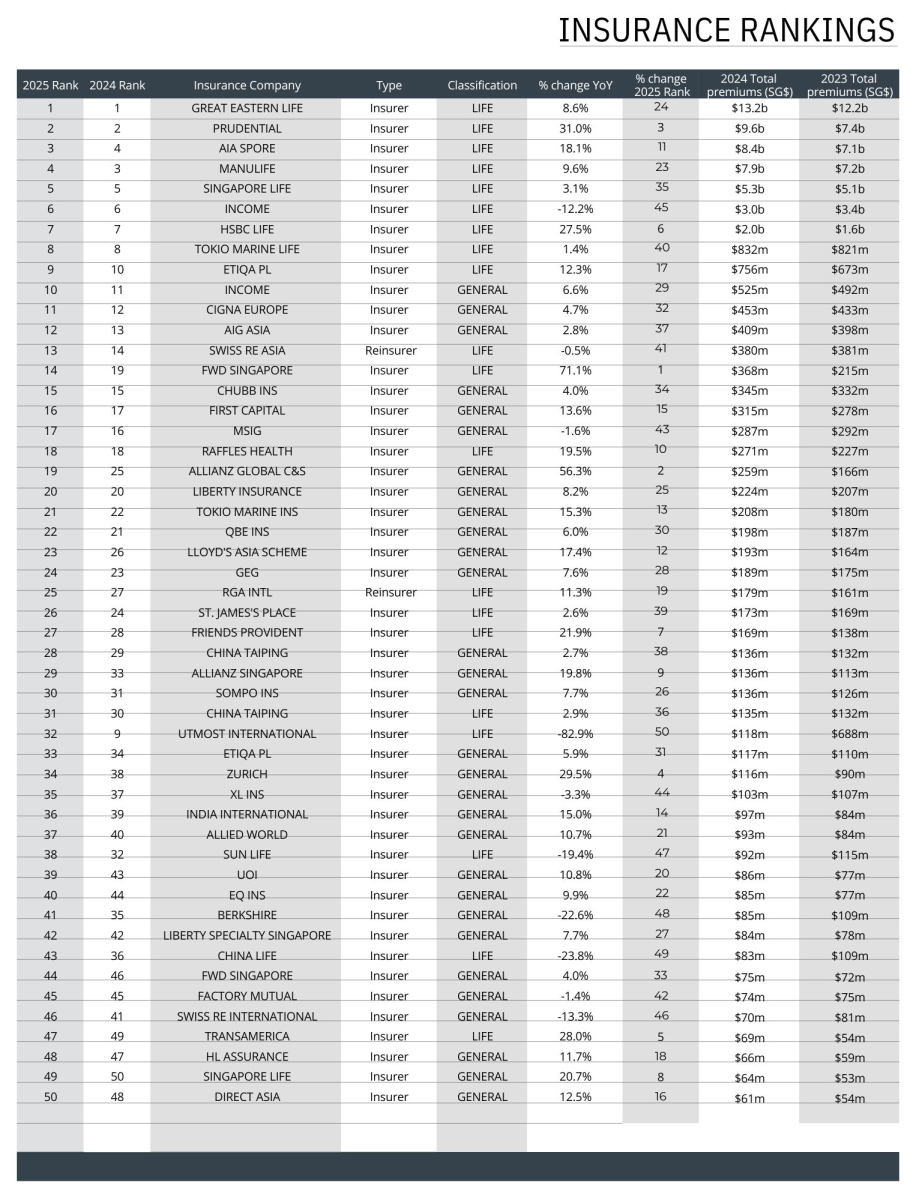

The annual rankings list the 50 biggest insurance companies in Singapore by gross premiums, based on Monetary Authority of Singapore data. The list comprised 18 life insurers, 30 general insurers and two life reinsurers, underscoring the breadth and diversity of the city-state’s insurance market.

Life insurers dominated the rankings. Great Eastern Life Assurance Co. Ltd. ranked first after booking $10.2b (S$13.2b) in premiums in 2024. Group CEO Greg Hingston attributed the solid performance to steady growth in its core product lines.

“We have broadened our product offerings in 2024, introducing customer-centric propositions to address the growing demand for wealth management,” he said in an email interview.

Hingston added that shorter-term single premium plans performed well in 2024.

Prudential Plc ranked second, with gross premiums surging 31% to $7.4b (S$9.6b), marking one of the strongest growth rates among major players. AIA Singapore Pte. Ltd., Manulife (Singapore) Pte. Ltd. and Singapore Life Holdings Pte. (Singlife) all placed third.

Manulife Singapore CEO Benoit Meslet said the insurer’s standing was reinforced by enhancements to its whole-life solutions.

“We also introduced new solutions for high-net-worth individuals seeking legacy planning and wealth accumulation, reinforcing our leadership in this segment,” Benoit stated in a written response to Insurance Asia/Singapore Business Review.

These boosted Manulife’s position in the high-net-worth segment, Meslet said, adding that geopolitical uncertainty had also shaped customer behaviour, with more people prioritising protection and long-term financial security.

Singlife’s 2024 performance showed a deliberate shift toward long-term value and quality, CEO Pearlyn Phau said.

“We realigned our distribution channels to sharpen productivity, segmentation, and mix management across bancassurance, financial advisory (FA), and owned Distribution networks,” Phau told the magazine in a written response. “This enabled us to deliver strong results in the non-participating funds segment, achieving 4% quarter-on-quarter growth against a flat market,”

Regular premium sales at Singlife rose 45% year on year, outperforming the broader market’s 26% increase.

Phau said the gains came from more productive sales staff, better adviser targeting, and customers keeping their policies longer.

She added that updated incentives and data-based tools helped shift the focus from volume to quality.

High-net-worth promise

Across the life insurance sector, investment-linked plans were the main draw for customers in 2024, driving much of the industry’s expansion, according to the Life Insurance Association of Singapore.

In 2024, the life insurance industry paid out $14b (S$18.1b) to policyholders and beneficiaries, 33.4% more than a year earlier, reflecting higher claims and maturing policies.

The general insurance market was supported mainly by the motor, health and property segments, which accounted for industry shares of 21.6%, 20.5% and 14.8%, respectively, based on data from the General Insurance Association.

Rising healthcare use and steady demand for motor coverage underpinned premiums, even as competition across lines remained intense.

Insurers expect sustained demand in wealth planning and high-net-worth segments in 2025 and 2026, but economic uncertainty may slow growth.

Hingston said Great Eastern expects softer demand for shorter-term single premium plans as customers pivot toward longer-term financial planning solutions.

“Looking to 2026, we expect the macro-economic environment to remain volatile which may impact relative premium growth,” said Hingston.

Manulife also struck a measured outlook. Meslet said demand for globally diversified wealth solutions is expected to hold, whilst geopolitical tensions and interest rate uncertainty could weigh on sentiment. Still, he said Singapore’s position as a regional wealth hub continues to support demand for sophisticated insurance and investment products.

Phau expects steady premium growth for Singlife, supported by rising retirement and long-term care needs.

“At the same time, we anticipate headwinds from pricing pressures, regulatory changes, healthcare cost inflation, and global economic uncertainty. These factors will likely moderate overall momentum across the industry,” Phau said.

She also cited Singapore’s ageing population as a challenge, noting that long-term care costs average about $2,326 (S$3,000) a month, whilst only one of three Singaporeans feel financially prepared, pointing to a widening protection gap over time.

For reinsurers, Singapore faces a heightened and evolving risk environment beyond pricing, Greg Carter, Managing Director, Analytics, EMEA & Asia Pacific at AM Best, told the magazine in a call interview.

“We’ve seen disruptions. We’ve seen potential impacts of trade tariffs,” he said. “What the industry has a good track record of is responding to changing risk environments,” Carter said, citing trade credit insurers in particular for their ability to reprice risks quickly and manage exposures.

As a result, AM Best does not currently expect these disruptions to have a “significant negative impact on the sector."

Looking further ahead, Carter identified artificial intelligence, wider technology use, and cyber risk as key trends that will drive competition in the reinsurance market.

“In terms of underwriting risk, we've seen growth, but they also present a challenge. Challenges to the industry itself in terms of data protection, data security,” Carter said.

“I think if you look across the across the sector, then this has been one of the, one of the hot topics over the course of the last couple of years, and I think will be a key element in 2026 so companies willingness to underwrite those kinds of risks, particularly cyber risks, will be a key point to watch on the longer term trends,” Carter added.

Below is the table of the Singapore Insurance Rankings* 2025:

*Note that this year's edition is not comparable with the previous year's edition. Gross premiums were gathered from the Monetary Authority of Singapore's annual data for both life and general insurance business. The table ranks data for the annual year 2024 against 2023.

Advertise

Advertise