Only 56% of S’pore graduates see insurance as appealing career choice

Seven in 10 said there was limited career growth in the industry.

Whilst the insurance industry aligns with graduates’ priorities in areas like salary, benefits, and job stability, only half (56%) of Singaporean graduates saw it as an attractive career path, according to Canopius’ report, titled “Listening to Tomorrow’s Leaders: Attracting and Retaining Young Talent into Insurance.”

The survey revealed that 31% of respondents prioritise salary and benefits, followed by job stability at 17%.

Work-life balance, company culture, and travel opportunities are less influential, with only 13%, 8%, and 7% respectively mentioning these factors.

Despite the potential for competitive career offerings, the insurance industry still faces misconceptions. Amongst respondents who did not view insurance as an attractive career, 70% cited limited career growth, 48% mentioned a lack of industry information, and 36% viewed the sector as unexciting.

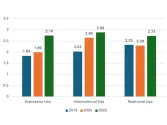

Notably, insurance is only slightly behind finance and consulting in perceived job stability and work-life balance, with 72% and 71% of respondents associating these attributes with insurance roles.

“From our research, it is encouraging to see that what young graduates seek is in line with what the insurance industry is already offering. Instead of reinventing the wheel, our focus should be on improving how we communicate about the job progression, compensation packages and the positive work environment that a career in insurance can offer,” Soon Keen Lee, Chief Executive Officer, APAC and MENA, Canopius Group, said in a release.

The survey, conducted in August 2024 amongst 154 recent graduates in Singapore, underscores an opportunity for the insurance industry to address perceptions and better attract future professionals.

Advertise

Advertise