Australia’s general insurance market to reach $93.9b by 2029

In 2025, the market is expected to reach $68b.

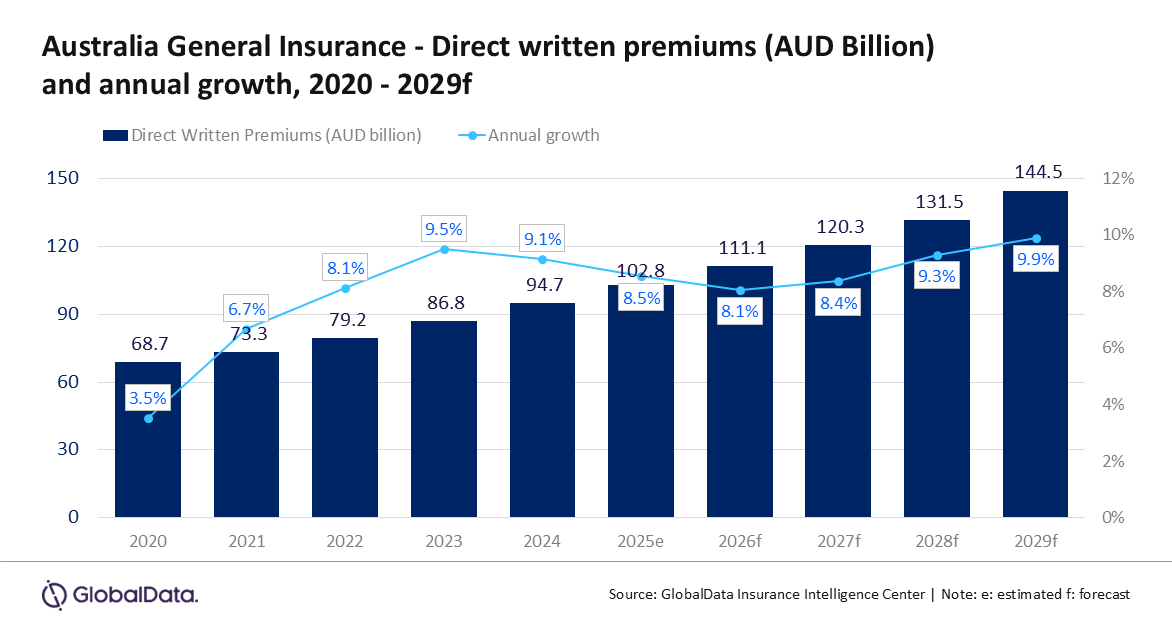

Australia’s general insurance industry is projected to average a compound annual growth rate (CAGR) of 8.8%, expanding from $62.5b in 2024 to $93.9b in direct written premiums (DWP) by 2029, according to GlobalData.

In 2025, the market is expected to reach $67.9b, up 8.6% year-on-year.

Growth is largely driven by increased demand for personal accident and health (PA&H) insurance, which made up 34.2% of total DWP in 2024.

The PA&H segment is forecast to grow 5.3% in 2025, supported by rising healthcare costs and the growing number of Australians holding private health insurance, which now exceeds 15 million or 54.9% of the population.

Property insurance, the second-largest line, is projected to hold a 27.0% share of DWP in 2025, after growing 14.7% in 2024.

It is expected to grow by another 13.7% in 2025, driven by higher claims costs, inflation, construction expenses, and increased demand following natural disasters.

Premiums for home multi-risk insurance have risen 65% over the past five years.

Infrastructure investments in renewable energy and transport are also contributing to this segment’s expansion.

Motor insurance, with an expected 26.4% share in 2025, is set to grow at a CAGR of 12.3% between 2025 and 2029.

Rising vehicle sales, higher input costs, and the transition to electric and hybrid vehicles are reshaping the market. Comprehensive motor premiums have jumped 42% since 2019.

Other lines, including financial, liability, and marine/aviation/transit insurance, are forecast to make up the remaining 13.4% of DWP in 2025.

Insurers continue to face pressure from inflation, elevated claims costs, and climate-related risks.

Whilst digital health solutions and customised policies are helping insurers adapt, concerns remain around sustainability and profitability, particularly with potential external risks such as a US reciprocal tariff potentially driving up claims costs.

Advertise

Advertise