Etiqa’s sustainability efforts focus on education and engagement

In 2022, Etiqa’s focus shifted from traditional corporate social responsibility plans.

For insurers looking to emulate a clear path for their environmental, social, and governance (ESG): start with governance, spread awareness, innovate boldly, and persist through challenges, urged Malaysia-based Etiqa Insurance & Takaful.

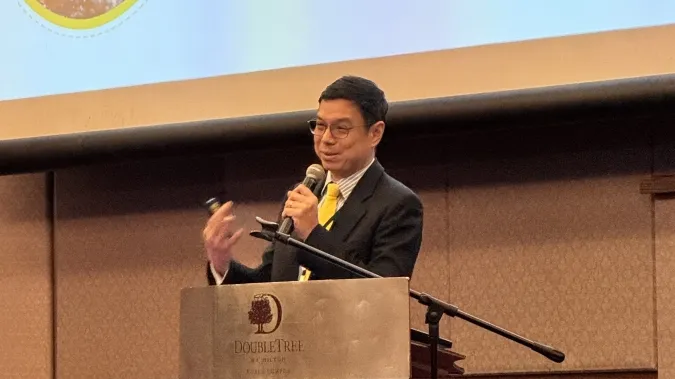

Chris Eng, the company’s Head of Sustainability, offered invaluable insights from their ongoing journey when he spoke at the Insurance Asia Forum in Kuala Lumpur last June.

Eng’s presentation at this industry conference in Malaysia highlighted the challenges and triumphs experienced by Etiqa, providing a roadmap for other financial institutions aiming to enhance their sustainability efforts.

Sharing Etiqa’s approach to sustainability, he said the firm first had to establish robust governance structures.

“We started with setting the governance,” Eng told forum participants. “Many of us in financial institutions understand the importance of governance and having an audit trail.”

This initial phase involved forming a dedicated committee to oversee sustainability initiatives, ensuring that progress was meticulously documented and auditable. This approach not only fostered internal accountability but also facilitated smoother audits and regulatory compliance.

The next step in Etiqa’s journey was to spread awareness and ensure alignment across the organisation.

Eng emphasised the importance of clarity and consensus. “My CEO says that what sustainability means to one person may not mean the same to another,” he said.

So, Etiqa undertook a comprehensive internal education campaign, clarifying the company’s sustainability goals and the significance of ESG considerations in their operations.

A critical aspect of this phase was understanding and setting targets for Scope 1 and Scope 2 emissions, as well as evaluating the sustainability of their investment portfolio. “We needed to understand our Scope 1, Scope 2, and where our investment portfolio stood in terms of sustainability,” Eng recalled.

This groundwork laid the foundation for more ambitious sustainability initiatives.

By 2022, Etiqa’s focus shifted from traditional corporate social responsibility (CSR) activities to developing innovative insurance products that promote sustainability.

Eng detailed how they ventured into new areas such as solar panel insurance and microinsurance, partnering with entities like the Employees Provident Fund (EPF) and the Ministry for Positive Living.

“We crafted products that would make a difference,” Eng noted, highlighting their proactive approach to integrating sustainability into their core business operations.

Going on record

One of the significant milestones for Etiqa in 2023 was the publication of its sustainability report. Eng recounted the challenges faced during this process, particularly the need to engage with stakeholders and shareholders early.

“The key lesson we learned from that was the importance of syndicating with your stakeholders and shareholders,” Eng said. This involved extensive consultations with Maybank Group's sustainability team to ensure the report aligned with broader corporate goals.

Eng underscored the importance of transparency and early engagement. “Syndicate early and fast, make it clear why you are embarking on whatever sustainability initiative you want to pursue, and hopefully, you will get support from HQ, which will expedite the process,” he advised.

This strategy not only facilitated the smooth publication of the report but also strengthened internal and external buy-in for their sustainability initiatives, he said.

From investments to underwriting

Etiqa’s sustainability journey has not been without its challenges, particularly in the realm of investments.

Discussing the complexities of assessing ESG risks in their equity and bond portfolios, Eng said: “It's easy to do; Bursa Malaysia requires a sustainability report from all listed companies now.”

Still, evaluating the ESG aspects of fixed-income investments proved more challenging due to the nuanced data involved.

Despite these hurdles, Etiqa persisted, extending its ESG assessment framework to its underwriting portfolio in 2024. Eng highlighted the importance of resilience and a willingness to tackle difficult tasks, enjoining the audience to “be resilient, keep moving forward, [and] tackle the difficult tasks once you've handled the quick wins.”

Lessons and future direction

Eng concluded his presentation with key takeaways from Etiqa’s sustainability journey. He emphasised the necessity of continuous improvement and adaptation: “Remember, syndicate early, syndicate with your shareholders," He also highlighted the importance of resilience, advising peers to "keep moving forward, don't stop at the quick wins, go down into the trenches and do the dirty work,”

Eng’s insights offer a practical guide for financial institutions navigating the complex landscape of sustainability.

By establishing robust governance, engaging stakeholders, innovating in product offerings, and tackling complex challenges head-on, companies can make significant strides in their ESG journeys. As Eng aptly put it, "The journey is ongoing, and the commitment to sustainability must be unwavering."

Advertise

Advertise