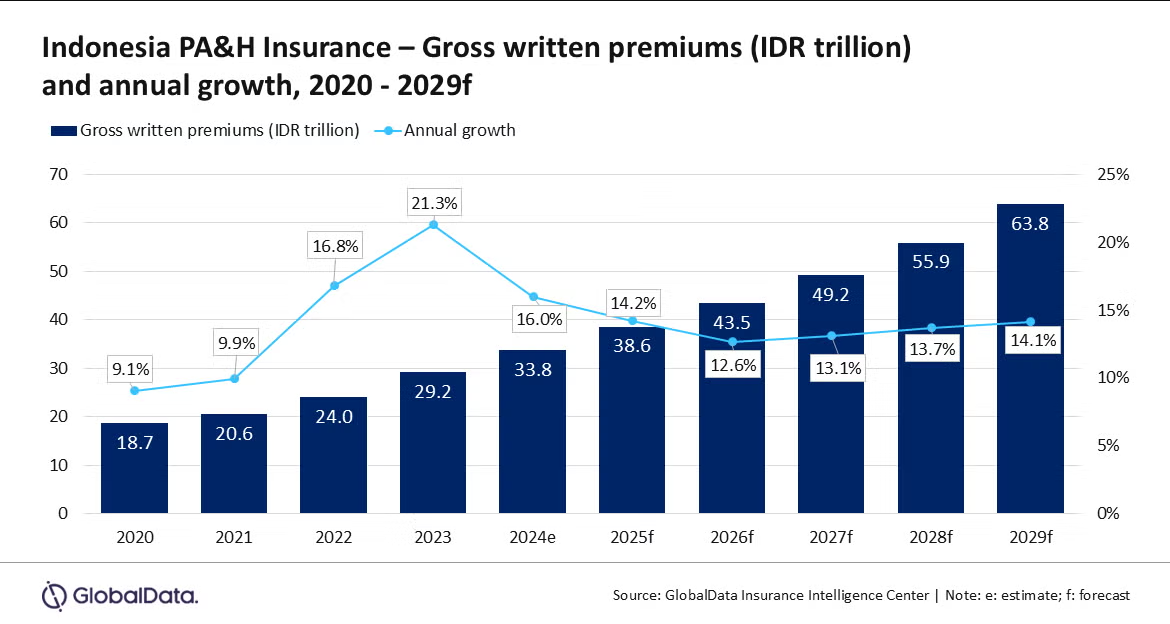

Indonesia’s PA&H slated for 13.4% CAGR through 2029

Growth in 2025 alone is estimated at 14.2%.

Indonesia’s personal accident and health (PA&H) insurance sector is projected to pencil a compound annual growth rate (CAGR) of 13.4%, increasing from $2.4b in 2025 to $4.0b in 2029, according to GlobalData.

The sector’s share of the total insurance market is expected to rise from 13.6% in 2025 to 16.7% in 2029.

Growth in 2025 alone is estimated at 14.2%, driven by rising demand for private health insurance and higher premium rates.

Manogna Vangari, Insurance analyst at GlobalData, attributes the continued double-digit growth since 2022 to increasing awareness of health and financial risks.

Premium rate adjustments in response to inflation and the recovery of the tourism sector are also contributing factors.

Medical inflation and rising healthcare costs are creating affordability challenges for policyholders.

The Indonesian Life Insurance Association reports that continued increases in healthcare expenses are forcing insurers to raise premiums to maintain coverage.

Insurers are increasingly targeting small and medium-sized employers, as underwriting large groups has become more difficult.

To control costs, companies are shifting from cashless services to reimbursement models, citing unnecessary treatments recommended by some healthcare providers.

General PA&H insurance claims are expected to rise at a CAGR of 10.9% from $535.9m in 2025 to $816.3m in 2029.

This increase is linked to higher prices for pharmaceutical ingredients and medical devices, much of which are imported, further strained by the weakening of the local currency.

To address rising claims and healthcare costs, the Financial Services Authority is preparing a new Circular Letter (RSEOJK) aimed at coordinating benefits among insurers and standardising co-payment requirements.

The regulation will mandate a minimum 10% co-payment for outpatient services to discourage excessive use and reduce insurer costs.

Tourism is also playing a role in the sector’s growth. According to the Central Statistics Agency, foreign tourist arrivals reached 13.9 million in 2024, up 20.17% from the previous year and the highest in five years.

Insurers are increasingly turning to digital solutions and new product models to meet market demands, while upcoming regulatory measures aim to improve industry stability.

Advertise

Advertise