Foreign reinsurers raise India market share to 49% in FY 2024

According to GlobalData, this share is expected to surpass 50% in 2025.

Licensed foreign reinsurers have continued to expand their footprint in India, with their gross written premium (GWP) market share rising from 25.8% in 2019 to 49% in the financial year ending March 2024.

According to GlobalData, this share is expected to surpass 50% in 2025, driven by regulatory reforms, competitive pricing, and increased demand for reinsurance across key lines.

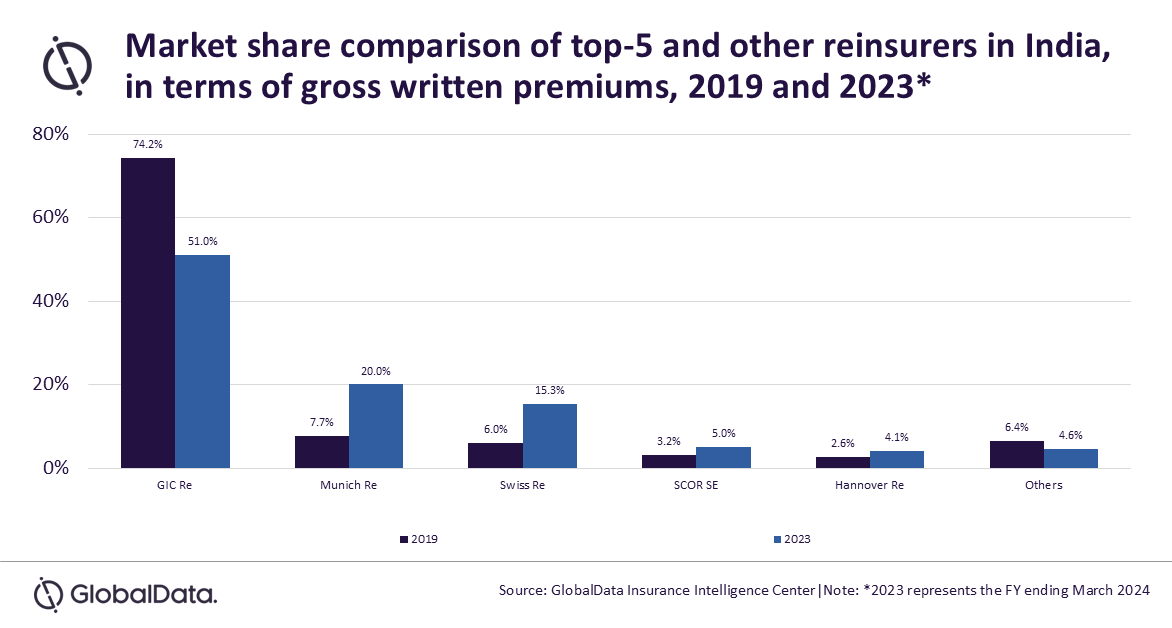

The Indian reinsurance market remains concentrated, with the top five players—comprising four foreign reinsurers and one domestic reinsurer—accounting for 95.4% of total GWP in 2023.

The market share of the top four foreign reinsurers grew from 19.4% in 2019 to 44.4% in 2023. All four reported double-digit compound annual growth rates between 2019 and 2023.

General Insurance Corporation of India (GIC Re), the dominant domestic reinsurer, saw its market share decline from 74.2% in 2019 to 51% in 2023.

This drop is attributed to a reduction in the obligatory cession rate, continued losses in agriculture reinsurance, and a decline in non-obligatory business.

In 2023, obligatory business accounted for 39% of GIC Re’s total earnings, with 61% coming from non-obligatory business.

The IRDAI (Re-insurance) Regulations, 2018 have enabled foreign reinsurers to open branch offices and underwrite local business.

GIC Re’s advantage in having first right of refusal through obligatory cessions may diminish, as insurers increasingly oppose the arrangement due to unattractive commission structures.

With stronger balance sheets and improved underwriting capacity, insurers are less reliant on compulsory reinsurance arrangements.

The government’s plan to divest up to a 10% stake in GIC Re, in line with SEBI’s minimum public shareholding requirement of 25%, could further impact the company’s position in the market.

In 2023, property, motor, and personal accident and health (PA&H) insurance made up 84.6% of total reinsurance ceded by general insurers.

These same lines also drove the growth of foreign reinsurers, with property and motor insurance accounting for 70.8% of total business for the top four foreign reinsurers.

Foreign reinsurers held 50% of the motor reinsurance ceded business and 26% of the property reinsurance ceded business.

Loss ratios remain high across major lines, contributing to demand for reinsurance.

Property insurance recorded an 83.6% loss ratio in 2023, whilst agriculture insurance reached 95.6%.

PA&H and motor insurance loss ratios stood at 87.5% and 80.6%, respectively.

GlobalData projects the Indian reinsurance market to grow at a compound annual growth rate of 7.3%, reaching $9.b by 2029.

“The initiative from IRDAI to increase insurance penetration under its ‘Insuring India by 2047’ will also support the growth of the reinsurance market during 2025 to 2029,” Swarup Kumar Sahoo, senior Insurance analyst at GlobalData said in a report.

“The market is expected to welcome more reinsurers in the coming years, which will increase competition and reduce the market share of GIC Re further,” Sahoo added.

Treaty renewal rates remain largely flat, and the soft reinsurance environment is likely to sustain competitive pricing and further erode GIC Re’s market share.

Advertise

Advertise