Increased losses from disasters push Philippines’ general insurance premiums up

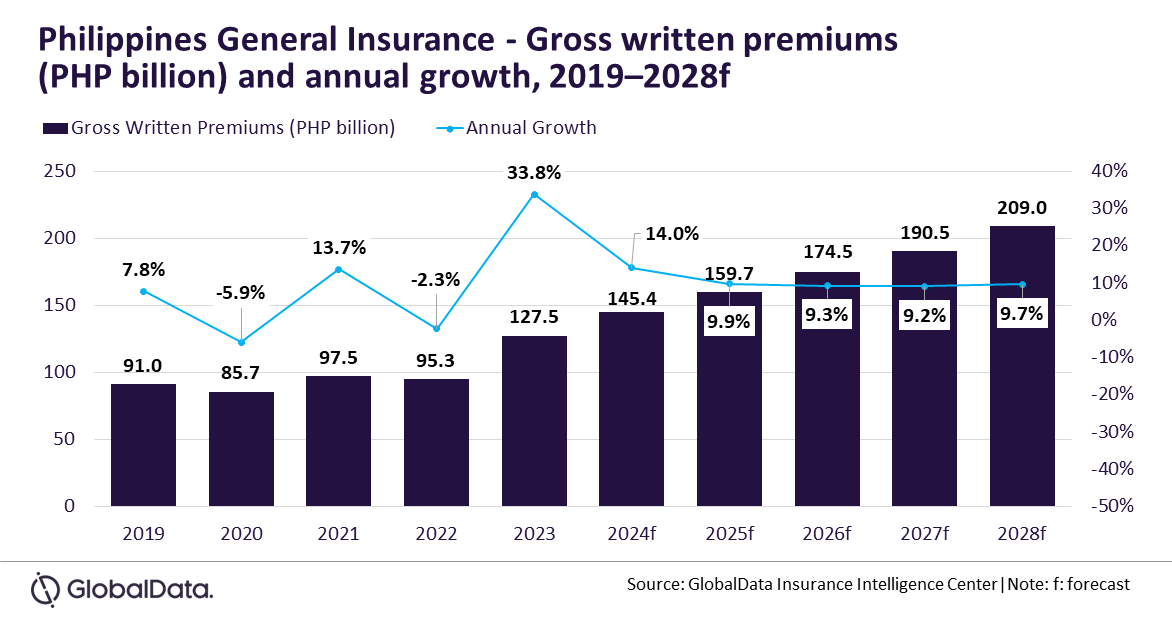

The industry is slated to grow by 14% this year.

The general insurance sector in the Philippines is forecasted to reach $3.8b in gross written premiums (GWP) by 2028, showing a compound annual growth rate (CAGR) of 9.5%, according to GlobalData. The sector is expected to grow by 14% in 2024, driven by economic expansion, increased construction activity, and the country's vulnerability to natural disasters.

In 2023, the industry saw its highest growth rate in five years, with a 33.8% increase, fueled by key economic sectors like automobiles, construction, and financial services.

Initiatives aimed at boosting financial literacy and inclusion have also supported the market’s growth, a trend expected to continue into 2024, according to Sutirtha Dutta, Insurance Analyst at GlobalData.

Property insurance remains the dominant segment, projected to account for 41.5% of the general insurance GWP in 2024.

This segment is expected to grow by 17.2% next year due to rising demand for policies covering natural catastrophes. In 2023, major disasters such as typhoons, floods, and earthquakes affected 12.1 million people and caused $417.6m (P23.2b) in losses, according to the Philippines Statistical Authority.

Government efforts to expand crop insurance and promote financial inclusion are also expected to contribute to the sector's growth.

The Department of Budget and Management has allocated $16.2m (P900m) for crop insurance in the first quarter of 2024, part of a planned $81m (P4.5b) investment for subsistence farmers and fishermen through the Philippine Crop Insurance Corporation (PCIC).

The PCIC has also partnered with CARD Pioneer Microinsurance Inc. (CPMI) in a move that marks the first public-private partnership in the country’s agriculture insurance sector. Property insurance is forecast to grow at a CAGR of 12.3% from 2024 to 2028.

Motor insurance, the second-largest segment, is anticipated to account for 24.5% of GWP in 2024, with an expected growth of 12.4% next year.

Rising vehicle sales are a key driver, with the Chamber of Automotive Manufacturers of the Philippines Inc. (CAMPI) and the Truck Manufacturers Association (TMA) reporting a 12.7% increase in sales during the first quarter of 2024 compared to the same period in 2023.

The motor insurance segment is expected to grow at a CAGR of 7.5% through 2028.

Marine, aviation, and transit (MAT) insurance is forecast to account for 6.3% of GWP in 2024, with 12.2% growth projected for the year, supported by expanding foreign trade and port developments.

Trade relations with Japan, along with the potential revival of the Philippines-EU free trade agreement, are expected to boost the country’s export business and drive MAT insurance growth.

Other lines, including liability, financial lines, and miscellaneous insurance, are expected to make up 27.8% of GWP in 2024.

“Growth in the construction and trade sectors and rising vehicle sales are expected to present a positive outlook for the general insurance industry over the next five years. Increasing losses from nat-cat events will prompt insurers to reassess their risk exposure and strengthen their underwriting practices that will lead to higher premium prices.” Dutta added.

($1.00 = P56.63)

Advertise

Advertise