What will drive the Thai general insurance market to reach $10.9b by 2028?

Motor, the largest segment, is expected a boost from EV registrations.

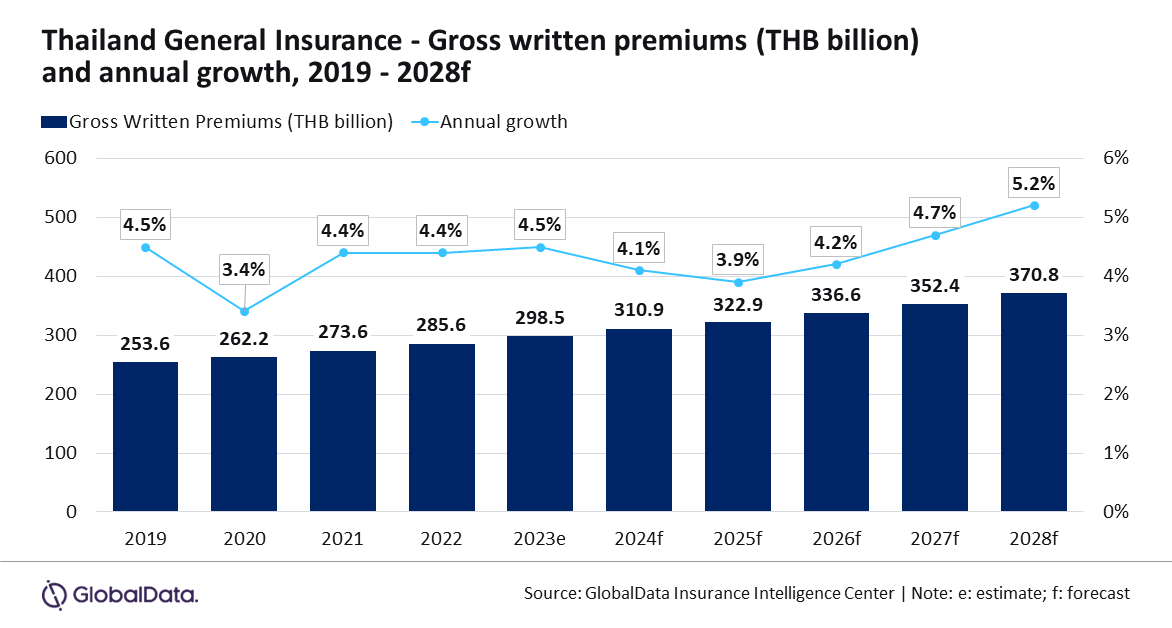

The general insurance market in Thailand is forecast to land at a compound annual growth rate of 4.5% from 2024 to 2028, according to GlobalData.

This is equivalent to accumulating about $10.9b gross written premiums (GWP) by 2028.

The general insurance industry in Thailand is projected to grow by 4.1% in 2024, driven by the property, motor, and personal accident and health (PA&H) sectors, which are expected to account for nearly 90% of total general insurance premiums, according to GlobalData’s Insurance Database.

Insurance analyst Manogna Vangari noted that the industry saw 4.5% growth in 2023, spurred by increased demand for property insurance, rising health awareness, and regulatory reforms.

Motor insurance, the largest segment, is expected to account for 53.8% of general insurance gross written premiums (GWP) in 2024, with a growth rate of 3%, slightly down from 3.9% in 2023 due to a decline in domestic car sales.

Car sales fell 23.9% from January to April 2024. However, the sector is expected to receive a boost from a 35.7% increase in electric vehicle (EV) registrations and positive regulatory developments, such as the establishment of standardized insurance codes and rates for EVs.

Higher road accident claims—up 2.6% from January to April 2024—are likely to push insurers to reassess risk exposure and increase premiums.

Motor insurance is projected to grow at a compound annual growth rate (CAGR) of 3.7% from 2024 to 2028.

Property insurance, accounting for 18.8% of GWP, is forecast to grow by 9.4% in 2024, supported by government investments in tourism infrastructure, energy projects, and housing.

The construction sector is expected to grow by 3.5% in 2024, contributing to property insurance expansion.

“Its growth in 2024 will be supported by an improvement in residential demand, highlighted by the increase in the value of outstanding mortgage loans and the number of residential land development licenses issued, which will support property insurance growth. However, in the short term, geopolitical tensions and elevated costs for materials and energy will pose a downside risk to property insurance claims,” Vangari said.

New fire insurance premium amendments introduced by the Office of the Insurance Commission (OIC) in March 2024 aim to align premium calculations with modern risk assessments.

PA&H insurance is also expected to grow by 3% in 2024, driven by increased health awareness and rising medical costs. It is forecast to grow at a CAGR of 4.2% over 2024–28.

Liability, financial lines, and marine, aviation, and transit insurance are expected to make up the remaining 10.1% of general insurance premiums in 2024.

“Initiatives from the government and favourable regulatory reforms will help in increasing the general insurance penetration rate in Thailand (1.59%), which was lower as compared to other regional markets such as Australia (3.52%), New Zealand (2.23%), Japan (1.75%), and Hong Kong (1.65%) in 2023. Persistently high claim payouts led by inflation and rising cases of road accidents will prompt insurers to reassess their risk exposure and increase premium rates in the short term,” added Vangari.

Advertise

Advertise