Why are insurers barely earning the cost of capital?

These issues have plagued the industry for a decade.

The pandemic may have taken a huge toll on the insurance industry, however, there are still issues, like persistently low interest rates and digital challenges, that remain unresolved that consistently puts a drag on profits, according to a report by management consulting firm McKinsey & Company.

The COVID-19 pandemic may have been the major driver in the industry’s distress today, however McKinsey said past issues have now taken on an even greater urgency resulting in the insurance industry barely earning cost of capital.

“After decades of stable returns, insurance is now a value-destroying industry in which half the players do not earn their cost of equity,” McKinsey said.

The report identified three ‘structural factors’ challenging the industry’s growth: persistent low interest rates; pricing pressures driven by fee transparency, digital attackers, and lower-cost options—pressures that in some markets are aggravated by price comparison websites; and organic demand that is growing only slowly in mature markets.

The latter is particularly worrying, because growth in developed economies is coming mostly from price increases rather than from volume or new risks covered, highlighting a risk that the industry might lose its relevance over time

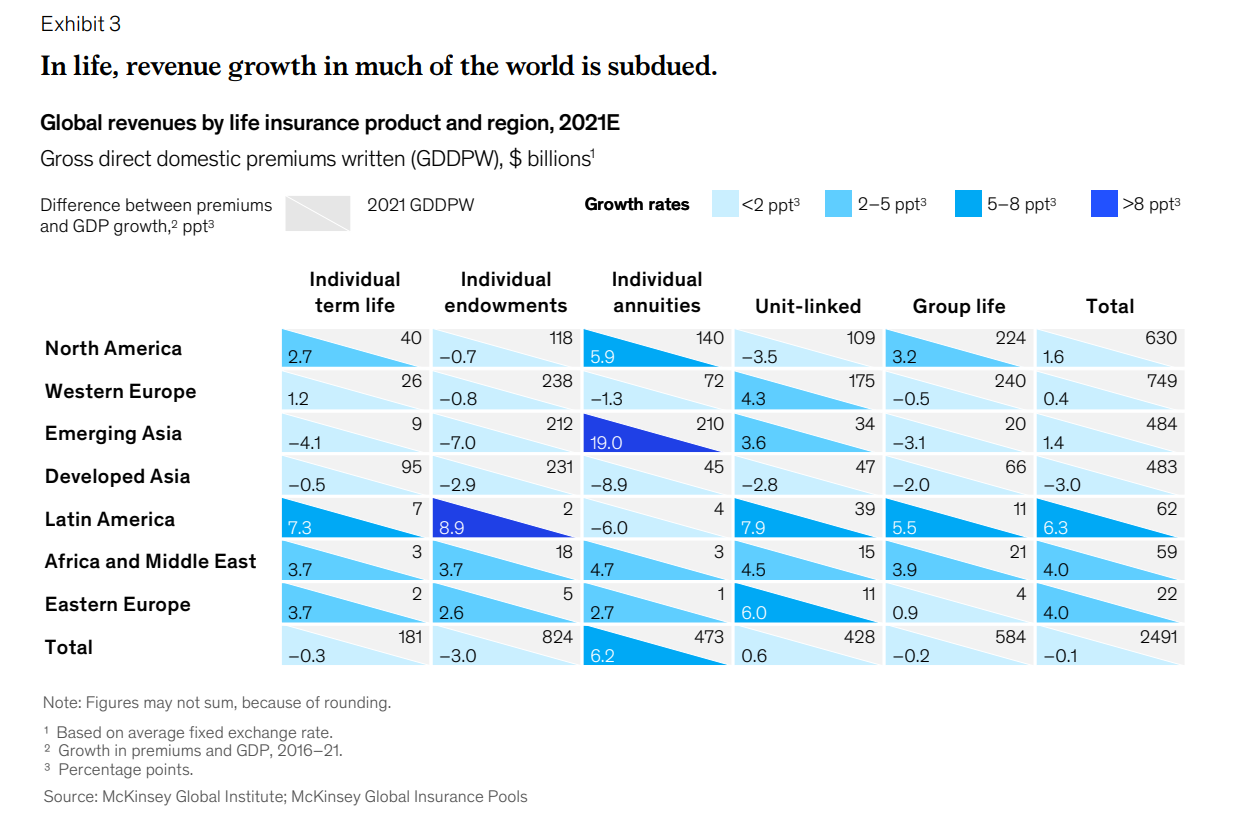

In the global life insurance segment, growth has been subdued

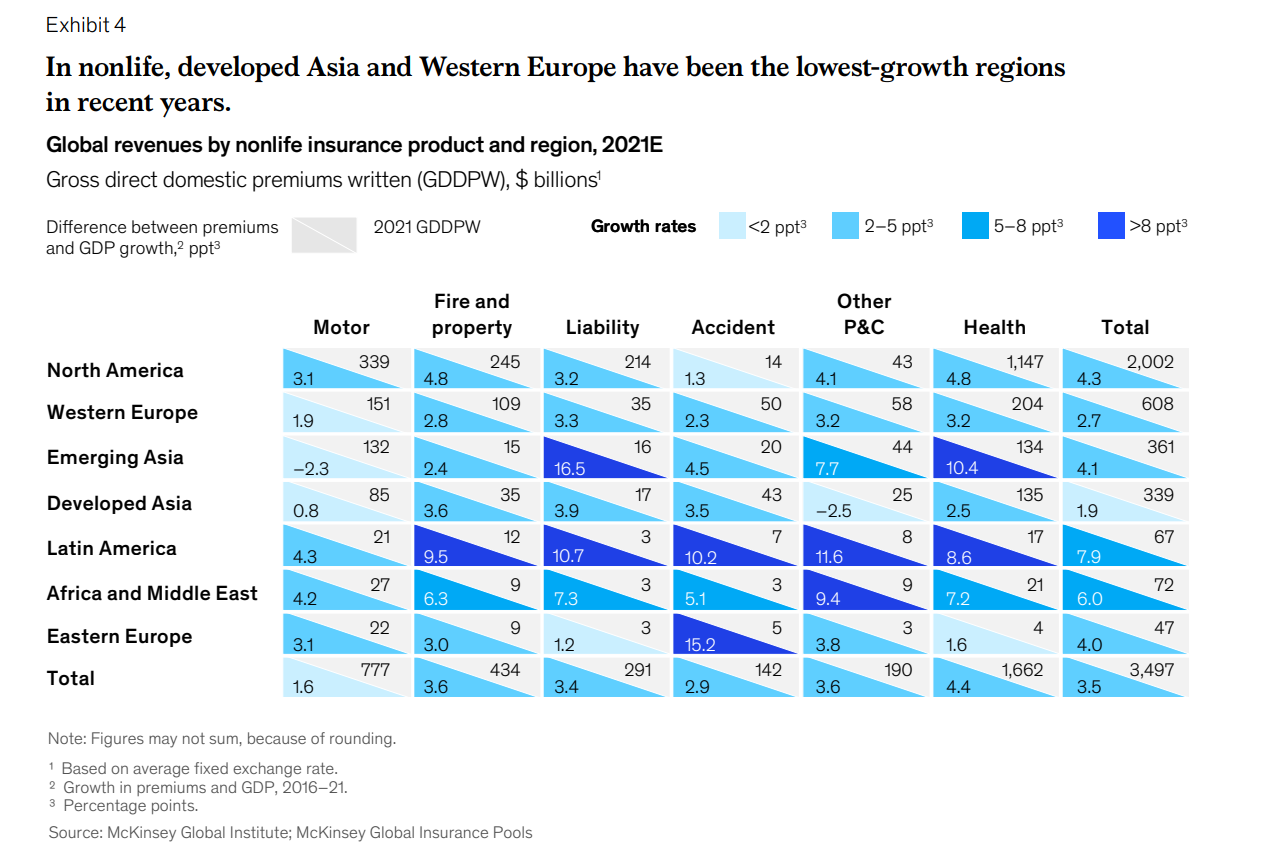

The non life-sector, especially in Asia and Europe has seen the lowest growth rate in years.

Insurtechs role

McKinsey said that a distinctive digital customer experience—from attackers or incumbents—will be a prerequisite for industry-beating growth.

As such, insurtechs are poised to drive digital innovation and disruption in the industry, as insurtech investments worldwide grew from $1b in 2004 to $14.6b in 2021.

“More than 40%t of insurtechs are focused on the marketing and distribution segments of the insurance value chain, enabling them to solve customer pain points through a digitally enhanced client experience that could pose a competitive threat to incumbents. And while some of these players have seen their share,” McKinsey said.

McKinsey adds that the traditional approach of many insurers will find themselves challenged by superior technology and healthy margins in insurance service business to own the whole value chain, forcing traditionally insurers to form partnerships or make outsize investments to keep up.

Insurance brokers winning

Brokers were revealed to be the clear winners of the industry, with both public and private investors recognising their position of strength in the insurance value chain.

Insurance brokers saw a much higher total shareholder returns (TSR) than for other industry segments. Global brokers TSR increased from 21.9% in 2010 to 2019 to 53.4% in 2020 to 2021. Property and Casualty (P&C) increased from 12.7% in 2010 to 2019 to 19.8% in 2020 to 2021.Multiline brokers saw its TSR increase from 9.8% in 2010 to 2019 to 14.9% in 2020 to 2021. Reinsurance brokers however declined by -4.4% in 2020 to 2021 and life and health brokers saw a slight drop to 7% in 2020 to 2021 from 9.7% in 2010 to 2019.

By geography, Asia Pacific brokers saw its annualised TSR drop to -3.4% in 2020 to 2021.

A value-destroying industry?

McKinsey blamed the ‘structural factors’ it identified as the reason behind the industry’s limited value creation in recent years.

“Not only has the overall insurance industry destroyed value in the past years, but its positioning has eroded from 2005–2009 to 2015–2019, with insurance brokers as the exception,” McKinsey said.

However, McKinsey emphasised that these problems are not caused by a few underperformers rather it is industry wide.

54% of listed insurers ,representing 52% of the global industry’s equity, had a return on equity (ROE) below their cost of equity over the past five years. This have raised questions about the long term economic viability of their business model

“In summary, after decades of stable returns, insurance is now a value-destroying industry in which half the players do not earn their cost of equity,” McKinsey said.

You may also like:

What’s in store for Asia’s insurance industry in 2022?

Singapore's top 50 insurance firms revealed a 17.22% increase in assets

Advertise

Advertise