Chinese life insurance premiums to hit 13% in 2020

Traditional life insurance and health insurance to hit 10% YoY and 26% YoY.

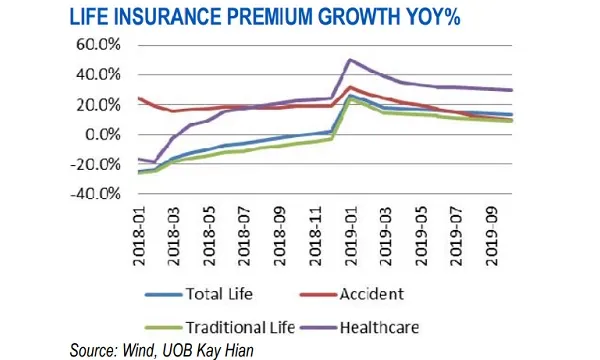

Chinese life insurance premium growth is expected to come at 13% YoY for 2020, with traditional life insurance and health insurance expected to record a 10% YoY and 26% YoY growth respectively, reports UOB Kay Hian.

Insurance premiums are expected to exhibit further slowdown in December 2019 amidst a high-base effect and historical trend, as premiums growth also straggled 13.1% in November.

Total premiums rose 11.9% YoY in November 2019, much weaker than the 14.1% YoY and 13.6% YoY in September and October, respectively. Growth in healthcare insurance premiums remained strong at 29.8% YoY in the same month whilst premiums growth in traditional life and accident insurance fell to 9% YoY and 9.9% YoY each.

The property & casualty (P&C) segment recovered in November, growing 8.5% YoY as premium incomes came in at $14.3b (RMB98.6b) from $12.8b (RMB88.4b) in October. Auto insurance inched up 11.2% YoY also in 11M 2019 whilst liability and credit & guarantee insurance posted growths of 34% and 24% YoY respectively. On the other hand, cargo insurance contracted 2.5% YoY but still better than 3.6% YoY in 10M 2019.

For 2020, P&C premium growth is expected to be at 8.5% YoY, auto insurance is posed to grow 4.5% YoY, whilst non-auto insurance is seen to grow 20% YoY.

Advertise

Advertise