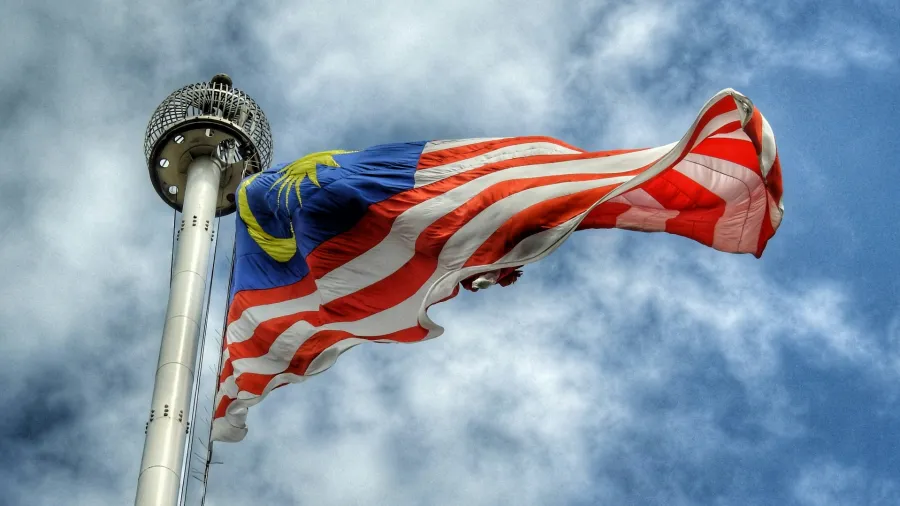

FWD Insurance launches affordable microinsurance for Malaysians

Qaseh Bakti Plus offers three plans for individuals aged 18 to 55.

FWD Insurance Berhad is collaborating with Bank Simpanan Nasional (BSN) to launch Qaseh Bakti Plus, a microinsurance product for underserved communities in Malaysia.

Addressing the needs of over three million B40 households, Qaseh Bakti Plus offers affordable coverage, focusing on income replacement during unforeseen hospitalisation. It falls under Bank Negara Malaysia's Perlindungan Tenang program.

ALSO READ: Malaysia’s PIAM awaits updated guidelines for vehicle repair

Qaseh Bakti Plus offers three plans for individuals aged 18 to 55, with premiums starting from RM0.17 per day. It provides comprehensive hospital cash benefits and doubles benefits for accidental causes.

The product is easily accessible at BSN branches nationwide, with a straightforward signup process.

Advertise

Advertise