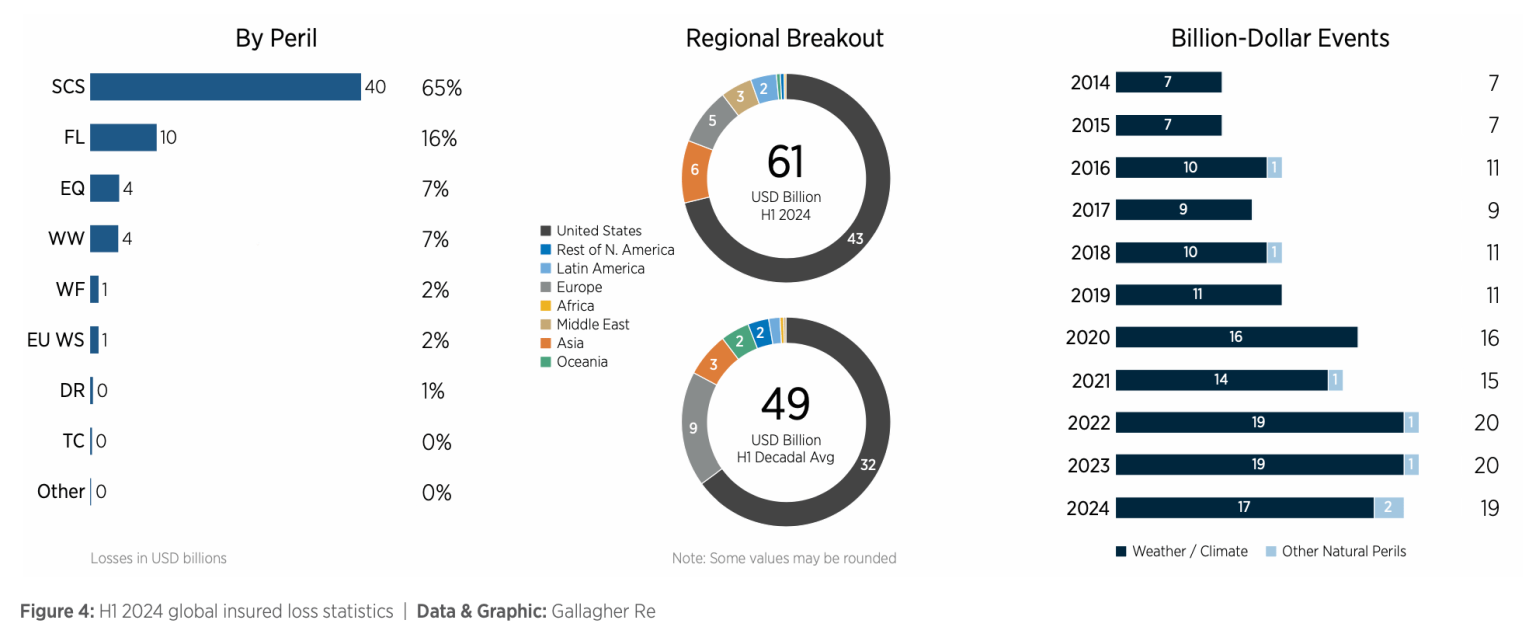

Global NatCat drive $61b in insured losses in H1 2024

The region accounted for 6% of the total.

In the first half of the year (H1 2024), global natural catastrophes resulted in well-above-average losses for the insurance industry.

It accumulated about $61b in global insured losses, the majority of which was a result of the US’ severe convective storm (SCS) activity, which held 61% ($37b) of the total. However, this figure is expected to rise further as losses continue to be assessed by both private insurers and public entities, Gallagher Re said in their latest Natural Catastrophe and Climate Report: First Half 2024.

Preliminary estimates also showed that H1 2024 incurred a total economic loss of approximately $128b, close to the decadal average of $133b.

Key contributors were six individual events with economic losses exceeding $5b each, spanning Asia, the United States, the Middle East, Europe, and Latin America.

Nineteen individual billion-dollar insured loss events were recorded, marking the second-highest H1 total on record after 2023 and 2022. Twelve of these events resulted in multi-billion-dollar losses, underscoring the severity of impacts noted by Gallagher Re.

Advertise

Advertise