IAG tops APAC insurance M&A rankings with $880m RAC purchase

The second-largest deal was Tian Ruixiang Holdings Ltd.’s $150m reverse merger.

Insurance Australia Group Ltd. (IAG) completed the largest insurance merger and acquisition (M&A) deal in Asia-Pacific by value in the second quarter, according to S&P Global Market Intelligence.

On 15 May, IAG announced a $880m (A$1.35b) transaction to acquire the insurance business of The Royal Automobile Club of Western Australia (RAC) and enter a 20-year exclusive distribution agreement for RAC-branded home, motor, and niche products.

The deal includes $261.87m (A$400m) for 100% of RAC Insurance shares and an upfront payment of $621.94m (A$950m) for the distribution rights.

The second-largest deal was Tian Ruixiang Holdings Ltd.’s $150m reverse merger with Ucare Inc., using newly issued Class A shares.

Other notable transactions included ATC Insurance Solutions Pty. Ltd.’s acquisition of Sterling Insurance Pty. Ltd. in Australia and Hanwha General Insurance Co. Ltd.’s absorption of Carrot Co. Ltd. in South Korea.

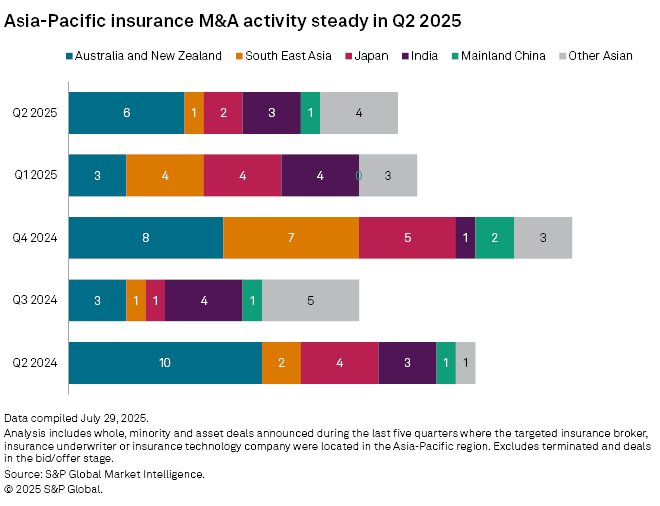

Australia and New Zealand recorded six M&A deals in the quarter, followed by India with three, Japan with two, and one each in Southeast Asia and China.

In India, Choice International Ltd. agreed to acquire the remaining 50% stake in Choice Insurance Broking India Pvt. Ltd. for about 630 million rupees.

In Japan, IRRC Corp. is acquiring Broad-minded Co. Ltd.’s insurance sales agency business, while Sasuke Financial Lab Inc. is purchasing broker Ateam Finergy Inc.

In comparison, the first quarter saw four deals each in Southeast Asia, Japan, and India, and three in Australia and New Zealand.

($1.00 = A$1.53)

Advertise

Advertise