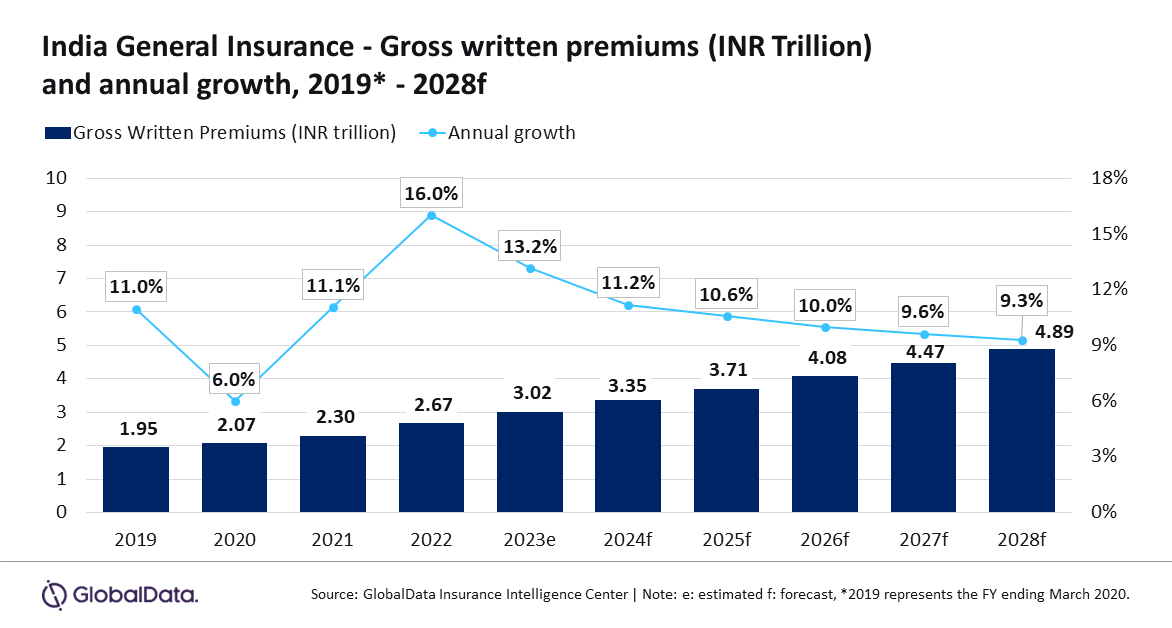

India’s general insurance sector slated to expand 11.2% in 2024

Motor insurance is anticipated to account for 31.1% of GWP.

The general insurance sector of India is projected to expand by 11.2% this year, thanks to personal accident and health (PA&H), motor, and property insurance lines, which account for the majority (93%) share of the total general insurance premiums in 2023.

GlobalData also forecasts the industry to reach a compound annual growth rate (CAGR) of 9.9% from $40.36b in 2024 to $57.3b in 2028, in terms of gross written premiums (GWP).

PA&H insurance, the largest segment, is forecast to hold a 39.5% share of general insurance gross written premiums (GWP) in 2024 and grow by 14.5%, influenced by heightened health awareness and rising medical costs.

This segment is projected to grow at a CAGR of 12.5% from 2024 to 2028. Positive regulatory changes, including the proposal for a healthcare regulator and the launch of the 'Bima Sugam' electronic marketplace by the Insurance Regulatory and Development Authority of India (IRDAI), are expected to further boost this sector.

Motor insurance, the second-largest segment, is anticipated to account for 31.1% of GWP in 2024, with a 10.4% growth rate driven by increased vehicle sales, which rose by 12.5% in March 2024 compared to the previous year.

“The growth in vehicle sales was also fueled by the government’s vehicle scrapping policy, which came into effect on April 1, 2023. The policy requires private vehicles older than 20 years and commercial vehicles older than fifteen years to be scrapped. Motor insurance is expected to grow at a CAGR of 7.9% during 2024-28,” GlobalData’s Insurance Analyst, Swetansha Chauhan said.

Property insurance, the third-largest segment, is projected to hold a 22.5% share of GWP in 2024, growing by 10.4% due to increased infrastructure investment, which has been allocated $134 billion in the 2024-2025 budget. This segment is expected to grow at a CAGR of 8.3% over the same period.

Liability, Marine, Aviation, and Transit (MAT) insurance, along with other general insurance products, are estimated to account for the remaining 6.8% of GWP in 2024.

GlobalData’s Chauhan also noted that the combination of economic recovery, rising disposable income, and favourable regulatory reforms will drive the growth of India’s general insurance sector.

Despite a current insurance penetration rate of 0.98%, which is lower compared to other Asian markets such as Japan, South Korea, Hong Kong, and China, these factors are expected to enhance penetration and growth in the coming years.

Advertise

Advertise