India's life insurance posts 32.2% drop in first year premiums for March

Life Insurance Corporation of India continues to lose its market share.

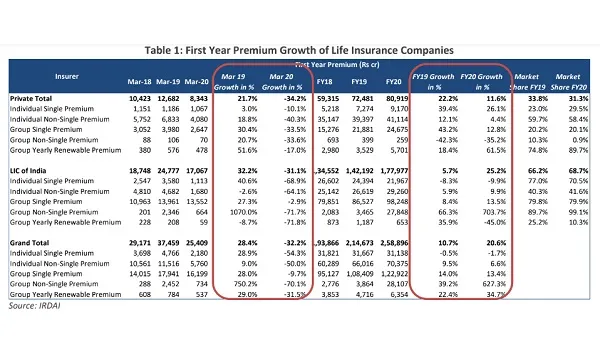

India’s life insurance sector reported a 32.2% YoY drop in first year premiums to $3.33m (Rs 25,409 cr) for March 2020, from the $4.92m (Rs 37,459 cr) recorded a year earlier, according to a report by CARE Ratings.

The fall was blamed on the negative impact brought about by the COVID-19 pandemic, the report said.

Despite this, the number of premiums grew 20.6% in FY2020 ending on 31 March, with the Life Insurance Corporation (LIC) of India recording a 25.2% growth for the full-year so far. Other private companies reported a 11.6% combined growth for the fiscal year.

“Due to robust overall performance and specifically in the group non-single premium segment, LIC posted more than a double increase compared to its private peers. LIC’s monthly group non-single insurance premium for the months of June 2019, July 2019 and November 2019 grew substantially, due to LIC’s announcement of withdrawal of higher yielding schemes and mobilisation from corporates seeking higher yields before the schemes end,” said CARE Ratings.

LIC has also regained an overall market share of close to 3% to reach 68.7%. However, this was not enough to reverse its losses in market share in the past years, with its share of individual first year premium (single + non-single) falling from 56% in FY2018 to 52% in FY2019 and to 50% in FY2020, the report noted.

The trend was even more pronounced for the month of March, with LIC sharply diving to a 35% market share in March 2020, from 51% in March 2019, and 52% in March 2018.

India’s insurance sector is expected to witness muted growth in the first quarter of FY2021 due to the extended lockdown. However, protection plans could witness an increase due to rising awareness and the online channel could see robust growth, the report concluded.

Advertise

Advertise