Insurers must adapt to 'liquid risk' amidst growing global volatility

Climate-related losses and AI-driven misinformation are already straining the industry.

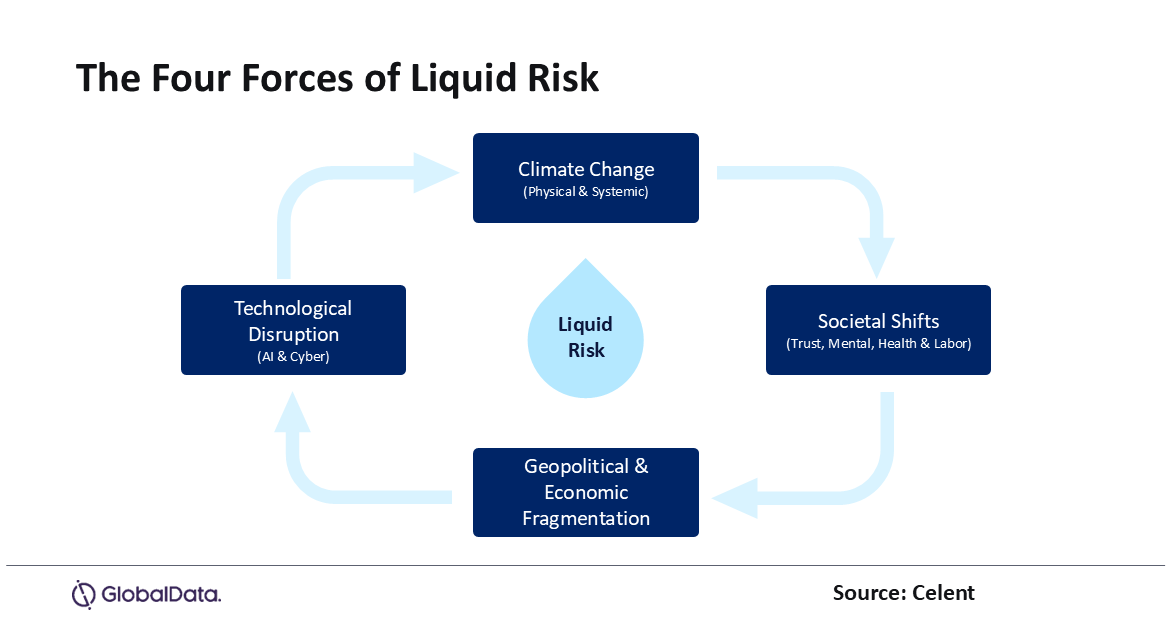

Traditional risk models are no longer sufficient as insurers face rising disruption from climate change, AI, geopolitical instability, and social fragmentation, according to a new report by Celent, a research arm of GlobalData.

In Navigating Liquid Risk: Rethinking Insurance for a World of Disruption, Celent introduces “Liquid Risk” as a new framework that sees risk as fast-moving, interconnected, and increasingly unmodelled.

The report argues that legacy systems built for a stable environment are unable to keep up, pushing insurers to adopt real-time, adaptive operations.

Fábio Sarrico, Senior Insurance analyst at Celent, said that the foundation of insurance, trust, is under pressure in a world where facts are often contested.

He noted that risk now cuts across sectors and borders, making it harder to predict and manage using traditional tools.

The report highlights how climate-related losses and AI-driven misinformation are already straining the industry.

It calls for cloud-native, event-driven systems and a rethink of product design to better address continuous and systemic risks.

Sarrico added that this shift is not just about digital transformation but about staying relevant in a world where volatility is the norm.

Advertise

Advertise