Japan life insurance sector to shrink 1%

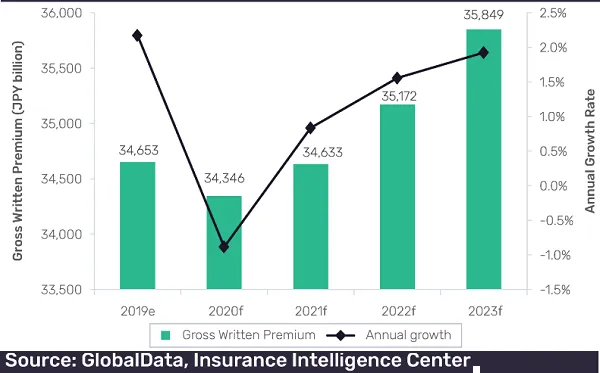

The segment is now poised to rise at a 0.9% CAGR from 2019 to 2023.

A 1% contraction is on the horizon for Japan’s life insurers this year as COVID-19 continues its trail, according to a GlobalData report.

Industry growth has now been revised to a compound annual growth rate (CAGR) of 0.9% from 2019 to 2023.

Emergency measures implemented to cushion against COVID-19 pushed the economy to recession, with GDP contracting 3.4% in Q1. This will have an adverse effect on new business premiums as insurers will face lower investment returns with the central bank slashing interest rates, said analyst Tapas Bhowmik.

Japan’s reliance on offline sales is also a blow to the industry. Per latest data, only 3% of products are sold through online channels whereas representatives and agents bring about 70% of sales.

Restrictions on movement and reduced face-to-face interactions are expected to hurt life insurance uptake in the short term, the report said. Whilst insurers are undertaking measures to bridge this gap, it is expected to take considerable time to achieve a significant level of digital transformation.

Advertise

Advertise