New Zealand insurance market to hit $9.6b GWP by 2029

The market is forecast to expand by 10.3% this year.

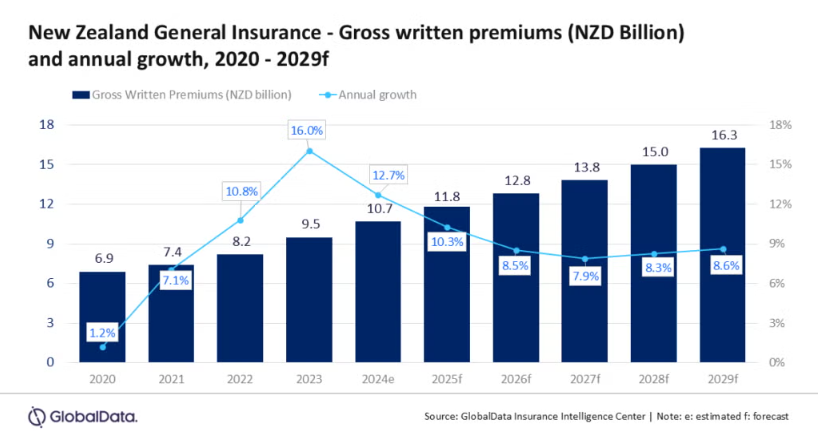

The general insurance market in New Zealand is slated to bag $9.6b in gross written premiums by 2029, according to GlobalData.

This is equivalent to a compound annual growth rate of 8.3% from $7.1b in 2025.

The market is forecast to expand by 10.3% in 2025, driven by rising medical costs and premium increases in property and motor insurance, which are projected to grow by 10.6% and 10.3%, respectively.

These two lines are set to account for 74.7% of the total GWP in 2025.

Property insurance, which is the largest segment, is expected to contribute 42.3% of the GWP next year.

“Personal property insurance will continue to support the growth of general insurance due to the rising number of weather events,” Swarup Kumar Sahoo, senior Insurance analyst at GlobalData, said in a report.

“Additionally, the increase in construction costs and rising repair costs are expected to further increase the premium rates,” Sahoo added.

Growth in this segment is attributed to higher construction and reinsurance costs, as well as ongoing reassessments of risk profiles following the introduction of the Natural Hazards Act in July 2024.

The impact of recent natural disasters has pushed the property insurance loss ratio up from 69.1% in 2022 to 96.0% in 2024, despite a decline in disaster frequency this year.

Motor insurance, accounting for 32.4% of the GWP in 2025, is facing challenges from supply chain disruptions, inflation, and a drop in new vehicle sales.

Premiums have increased as insurers seek to recover from high claims associated with events such as the Auckland Floods and Cyclone Gabrielle.

Liability insurance is projected to make up 8.1% of the GWP in 2025, supported by mandatory coverage and growing demand for directors and officers liability products.

The segment is expected to grow at a CAGR of 6.6% between 2025 and 2029, amidst rising awareness of cyber risks and stricter regulatory requirements.

The remaining 17% of GWP will come from other general insurance segments.

“However, challenges such as natural disasters and geopolitical uncertainties remain key risks that could impact the market’s outlook in the next two to three years,” Sahoo said.

Despite that, the market is expected to maintain its growth trajectory, supported by regulatory reforms, a stable economic environment, and increased adoption of insurtech solutions.

Advertise

Advertise