Seven countries benefit from initial anticipatory action and disaster risk reduction programme

Its goal was to minimise the impact of disasters on individuals and communities.

The Anticipatory Action (AA) and Disaster Risk Reduction (DRR) Initiative has completed its Phase 1 in seven risk-vulnerable countries.

During Phase 1, MapAction and Start Network collaborated closely with local partners in Nepal, Bangladesh, the Philippines, Zimbabwe, the Democratic Republic of the Congo (DRC), Senegal, and Madagascar to build capacity and address technical and process barriers in using GIM.

This initiative is organised by the Insurance Development Forum (IDF), a public-private partnership led by the insurance industry and co-chaired by the UN, the World Bank, and other international organisations. This is also in collaboration with MapAction and Start Network.

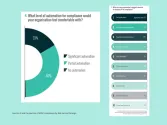

Key highlights of Anticipatory Action and Disaster Risk Reduction Initiative: Phase 1 include:

- Completion of missions in 7 crisis-vulnerable countries.

- Engagement of 13 MapAction Geospatial Information Management (GIM) experts.

- Training of over 150 community leaders in GIM.

- Progress on 7 critical data projects.

This effort helped uncover opportunities and facilitated collaborative work to tackle data-related issues in anticipatory action and DRR projects across these countries.

A significant part of Phase 1's work involved providing Geographical Information Systems (GIS) training to AA and DRR professionals, which was well-received and has generated a demand for more customised training.

This effort was supported and funded by seven member companies of the IDF: Aon, AXA, AXIS Capital, Milliman, Swiss Re Foundation, WTW, and Zurich Insurance.

ALSO READ: Less than half of APAC’s natural disasters were insured in the first semester 2023: Munich Re

In light of the global threat posed by climate change and the urgent need to adapt and mitigate its impact, especially for vulnerable communities, the initiative was launched in 2021.

Its goal was to accelerate anticipatory action and risk reduction in seven crisis-prone countries, with the aim of minimising the impact of disasters on individuals and communities. Phase 1 of the AA and DRR program has shown positive results, setting the stage for an ambitious Phase 2.

The initiative also reflects the commitment of the IDF and Start Network to the Risk-informed Early Action Partnership (REAP), of which they are members, and is managed under the IDF's Disaster Risk Reduction program.

The GIS training equips local NGOs with the necessary information to deliver effective humanitarian assistance after disasters. It allows them to determine where frontline workers are most needed and identifies challenges such as damaged roads and power failures that may affect their work.

MapAction, supported by IDF members, collaborates with Start Network to train humanitarian personnel in using geospatial and data technologies for anticipatory action and disaster risk reduction.

Building on the success of Phase 1, the IDF, in partnership with MapAction and Start Network, is working on the development of Phase 2 (2023-2025) to further enhance long-term crisis resilience and anticipatory action.

Advertise

Advertise