Singapore’s general insurance industry to hit S$7.35b in 2028

The industry will grow at a compound annual growth rate (CAGR) of 5.8%.

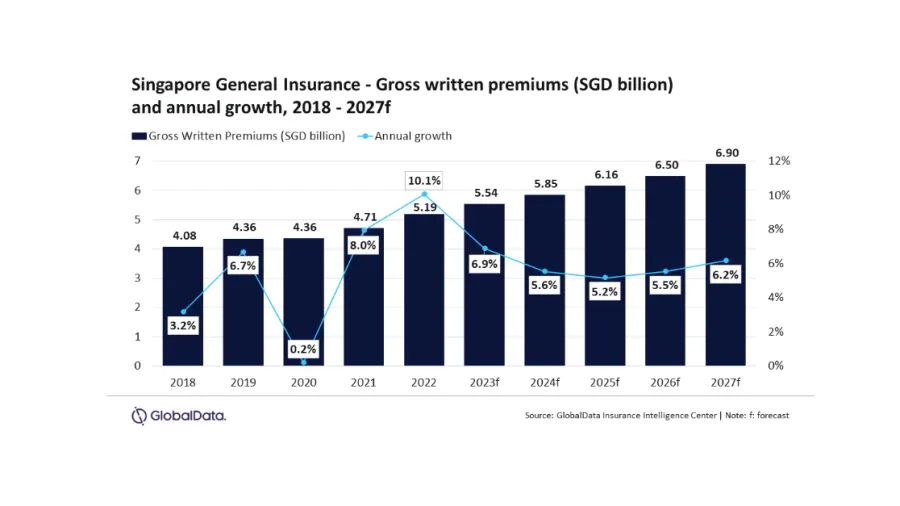

Gross written premiums (GWP) of Singapore’s general insurance industry will reach S$7.35b (US$5.5b) in 2028, growing at a compound annual growth rate (CAGR) of 5.8%.

According to GlobalData, investments in infrastructure projects and a rise in the demand for health insurance after the pandemic will support the industry's growth.

Industry growth, however, will slow down compared to 2021 and 2022.

For 2023 and 2024, GlobalData expects the industry to grow by 6.9% and 5.6%, respectively.

In terms of line of business, Personal Accident and Health (PA&H) insurance is leading the industry, accounting for a 23.9% share of the general insurance GWP in 2023.

In 2022, PA&H insurance grew by 32.6% on the back of heightened demand for health insurance due to increasing awareness after the pandemic, a rise in medical costs due to inflation, and the relaxation of travel restrictions.

Behind PA&H are property insurance and motor insurance, which accounted for a 19.1% and 18.4% share of general insurance GWP in 2023, respectively.

Liability, Financial lines, Marine, aviation, and transit (MAT), and Miscellaneous insurance accounted for the remaining 38.6% of the general insurance GWP in 2023.

Advertise

Advertise