Singapore’s life insurance slated for $43b premiums in 2029

Due to the ageing population, health awareness, and consumer spending.

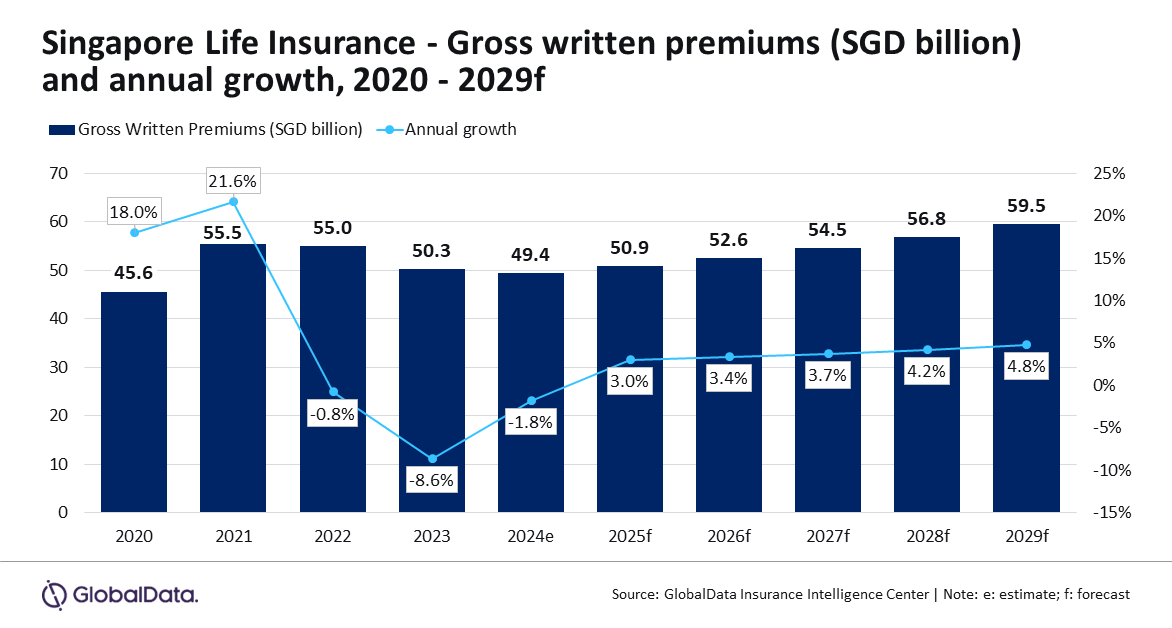

The life insurance sector in Singapore is forecast to bag $43.6b in gross written premiums (GWP) by 2029, possibly recording a compound annual growth rate (CAGR) of 4.0% beginning 2025, according to GlobalData

This growth is expected to be driven by an ageing population, increased health awareness, and a rebound in consumer spending.

The sector is forecast to expand by 3.0% in 2025, recovering from a decline in 2024 attributed to global economic uncertainty, inflation, and volatile markets.

“The industry is expected to gain momentum in 2025, supported by changing demographics and increasing health awareness that will drive the demand for personal accident and health (PA&H), and whole life insurance policies,” analyst from GlobalData, Manogna Vangari, said in the report.

Whole life insurance is the largest segment, accounting for an estimated 44.0% of GWP in 2024.

Although demand is expected to decline by 4.1% in 2024 due to inflation and rising interest rates, the segment is predicted to rebound with a 2.1% growth in 2025 and achieve a 3.1% CAGR over 2025 to 2029.

This growth will be supported by Singapore’s ageing population, which is projected to make up 18.0% of the total population by 2030.

Endowment insurance, the second-largest segment, is expected to account for 32.8% of GWP in 2024 and grow at a 3.7% CAGR through 2029, driven by rising interest rates and a shift toward wealth-focused products.

PA&H insurance, which is projected to hold a 14.2% market share in 2024, is expected to grow at a CAGR of 6.6% over the same period due to increasing healthcare costs and heightened health awareness.

The remaining 8.9% of the market in 2024 will comprise term life, general annuity, and other insurance products.

“The life insurance industry growth in Singapore is largely attributed to demographic shifts, bolstering demand for life and health insurance products, particularly amongst an increasingly affluent population,” Vangari said.

“The development of products tailored to the needs of the rapidly ageing demographic is expected to be a significant area of focus for the insurers over the next five years,” concluded Vangari.

Advertise

Advertise