Singlife introduces first market insurance for dementia care

Dementia is the 5th leading cause of disability in the country.

Singaporean insurer Singlife has launched the market’s first insurance plan, Singlife Dementia Cover, offering yearly payouts for individuals living with dementia and other mental health issues.

“Dementia is the fifth leading cause of disability in Singapore, and more are expected to get dementia as our population ages. We urgently need to prepare our society to live with dementia and are working with other stakeholders in the long-term care ecosystem to prepare Singaporeans,” Pearlyn Phau, Group CEO at Singlife said in a press release.

“Singlife Dementia Cover can help alleviate some of the financial challenges of dementia, but we think it is more important to raise awareness of how we can improve the wellbeing of persons living with dementia and their caregivers holistically.” Phau added.

ALSO READ: Singlife Philippines secures $10.7m for digital expansion

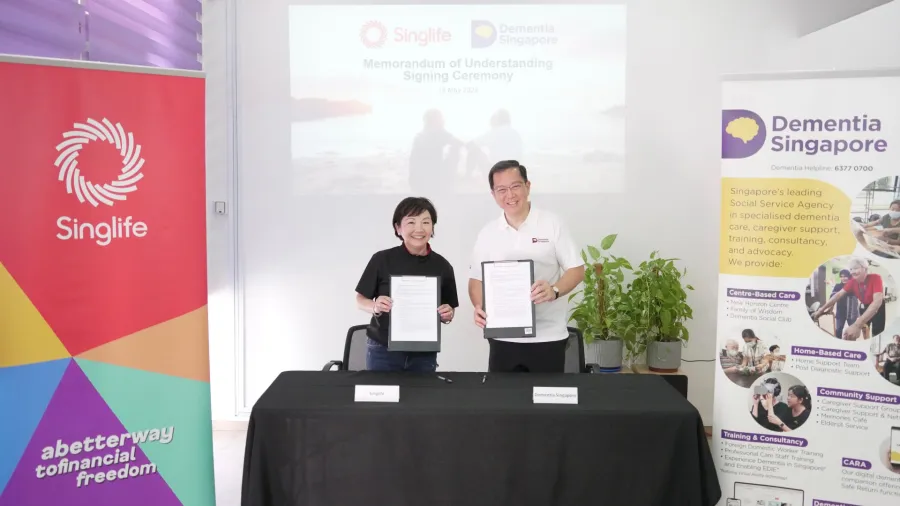

To support this initiative, Singlife has signed a Memorandum of Understanding with Dementia Singapore to enhance awareness and understanding of cognitive decline among its financial advisors and employees.

This partnership aims to equip them with the necessary knowledge to engage in meaningful conversations with clients and provide valuable support.

As dementia becomes a growing concern in Singapore, with an expected doubling of cases by 2030, Singlife Dementia Cover addresses the need for long-term care protection.

The plan offers annual payouts of up to S$10,000 for dementia and mental health conditions, along with lump-sum payouts for medical expenses and depressive or anxiety disorders.

It also includes provisions for late-stage dementia, allowing policyholders to receive annual payouts for up to 10 years without premium payments.

Advertise

Advertise