Vietnam insurers to benefit from interest rate hike

The rate hike will mean higher profits for insurers this year.

Insurance companies will have the chance to earn higher profits in 2023 because of the continual interest rate hike trend, according to a report by the state-run Vietnam News Agency.

Insurers are expected to have their profits increase this year as the majority of their investment portfolios are bank savings and government bonds, whose interest rates are forecast to remain at high levels in the year.

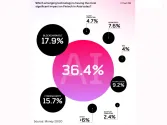

In Vietnam, regulations state that insurers have to use at least 70% of their capital to deposit at banks or buy government bonds to ensure the insurers’ capital safety. This mean, the current high interest rates of the two channels are an advantage for insurers to increase their profits.

As the interest rate hike trend is forecast to remain in 2023, the financial activities of insurance companies are expected to continually record positive results this year.

The US Federal Reserve last year raised interest rates by a total of 4.25-4.5% per year to curb inflation, the highest rate since January 2008. Fed is expected to continue increasing interest rates in the first quarter of 2023.

Advertise

Advertise